Modeling African Swine Fever’s Impacts on Livestock in China

Oct 06, 2021

On August 3, 2018, a highly contagious and deadly virus called African swine fever, which affects both domestic pigs and wild boars, was first reported in Liaoning Province. Soon after reports began to emerge, the Ministry of Agriculture and Rural Affairs (MARA) of the People’s Republic of China enforced the Swine Fever Contingency Plan that specifies measures to take for ASF identification; responses to mobilize depending on the severity of the events; emergency responses for suspicious and confirmed cases; procedures for tracing sources and spread; and related actions. Pig-related regulations (e.g., culling) were updated with terms directed specifically at ASF. Despite MARA’s swift action, ASF quickly spread from north to south and was found throughout the country by the end of the year. Figure 1 shows provinces with new reports of ASF (red) in each calendar quarter of 2018 and 2019 from MARA. In this article, we will discuss the significant impacts this disease outbreak had on China’s pork and insurance industries, as well as how to manage ASF risk to livestock in China using the AIR Multiple Peril Crop Insurance (MPCI) Model for China.

Understanding the Spread of ASF in China

Because ASF has no proven treatment or vaccine, controlling the spread of the disease depends on containment measures. Containing ASF, however, is challenging; the virus spreads not only through direct contact with infected pigs or contaminated feeding materials and fomites (objects or materials that are likely to carry infection, such as clothes, utensils, and furniture), but can also be transmitted through pork products in the human food chain. Appropriate sanitary measures must be strictly enforced for effective control. Complicating the issue further is misdiagnosis, as ASF symptoms are similar to those of classical swine fever (CSF). If ASF is not accurately identified, the carcasses of the ASF-infected pigs may be disposed of inappropriately and contaminate the environment, contributing to the regional spread of virus.

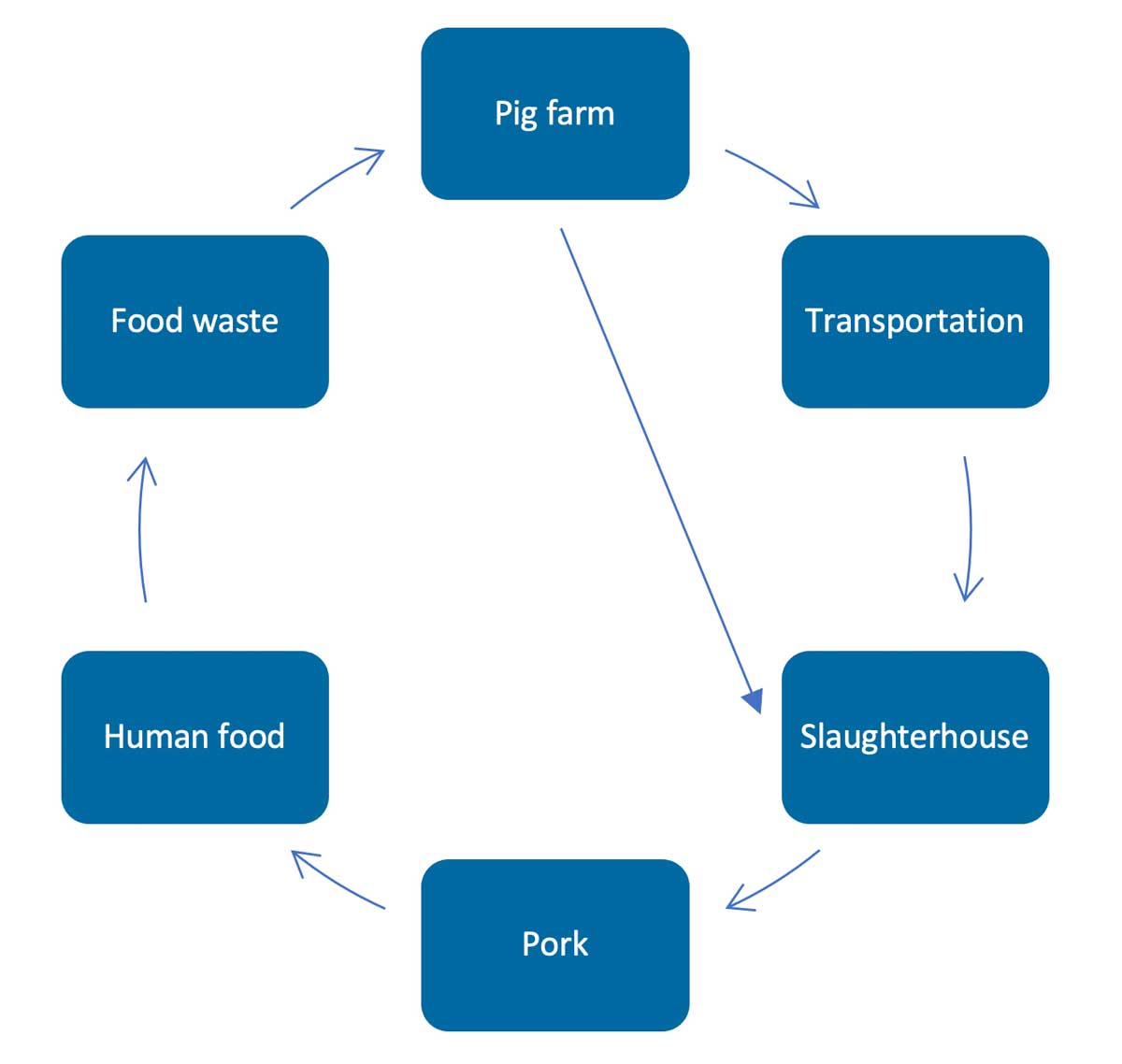

Transportation Contributes to the Spread

ASF can spread across a country via the transportation of both live animals and pork products, so testing at slaughterhouses is a crucial step in breaking the chain of transmission. In fact, the spread of ASF has been partially attributed to insufficient slaughterhouse testing by Chinese researchers in spite of the increasing regulations.6,7 Once the virus gets into the human food chain, it can spread widely because human food waste is often repurposed as feed for pigs, thus beginning a new cycle of transmission (Figure 2). Any failure to detect or confine ASF in this cycle can contribute to the spread of the virus.

Illegal Transportation of Pigs: Another Major Driver of ASF Spread

When ASF outbreaks are discovered, nearby pigs are culled to prevent transmission. Subsidized government compensation for culled pigs is available—but at a lower rate than the typical market price. Thus, when an area is suspected to have been exposed to ASF, farmers may “panic sell” pigs at low prices to mitigate their losses before the confirmation of ASF. The regional differences in pig prices may entice retailers to risk cross-region shipping of pigs, which is illegal without a valid animal health certificate and could lead to the spread of ASF to previously unexposed regions.6 During the latter stages of the ASF pandemic, an increasing percentage of reported ASF cases were associated with illegal pig transportation. According to MARA, 10% of ASF reports in 2019 were associated with illegal pig transportation, while 65% and 40% of reports were in 2020 and 2021, respectively.

Industry Impacts of ASF in China

In this section, we explore the impacts of ASF on two industries in China: the pork industry and the insurance industry. Then we delve deeply into how to model insurance industry losses.

Pork Industry Impacts

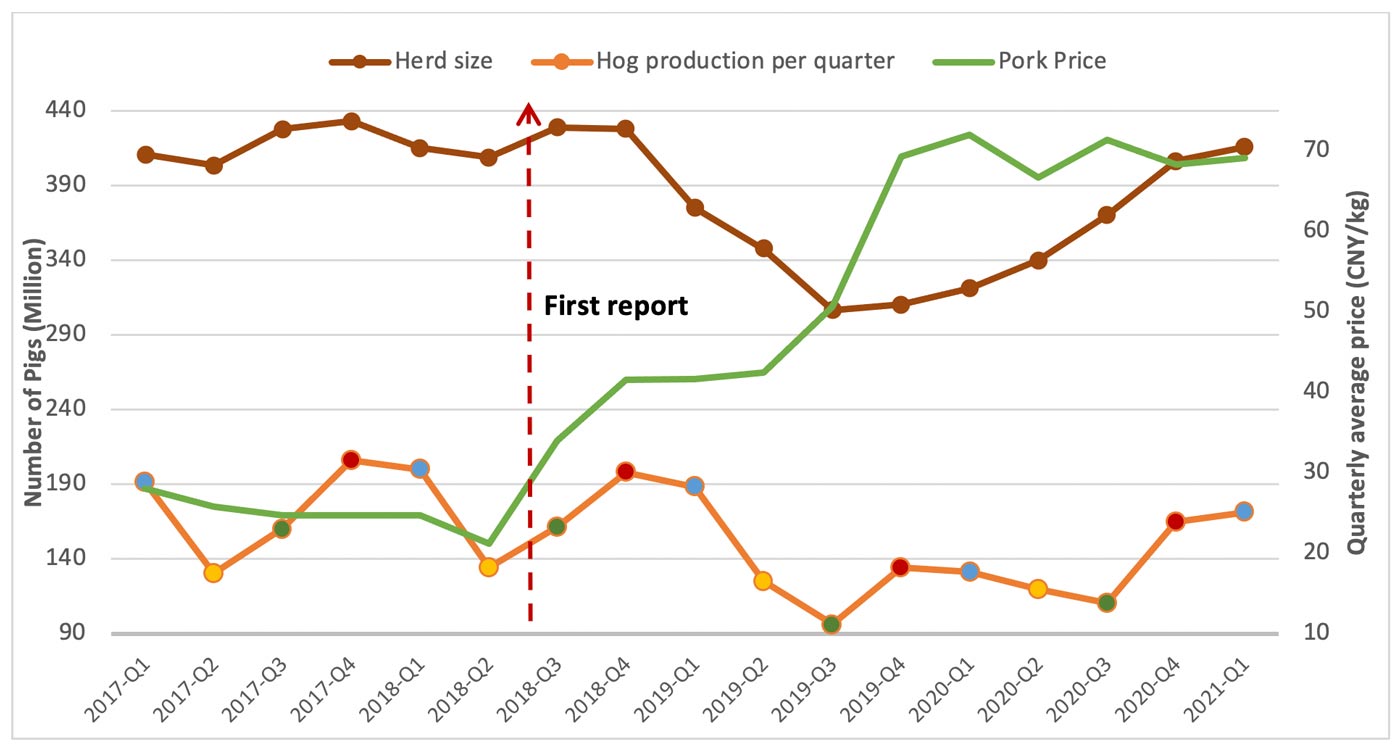

In 2019, hog production and herd size dropped dramatically and pork prices rose (Figure 3). By the third quarter of that year, herd size had fallen 25% from pre-ASF levels—a difference of 100 million animals—and hog production had been reduced by 40%. Pig herd size only recovered to pre-ASF levels by the first quarter of 2021, accompanied by a rebound in hog production. (“Hog” refers to mature animals only and is measured by the number of heads, whereas “Pig” is a term inclusive of juveniles and piglets as well; hog is the more common term used when referring to production.) The price of pork, however, remained at about double the pre-ASF value in the first quarter of 2021.

While estimates of how many animals have been affected by AFS have fluctuated, the numbers reported have been orders of magnitude smaller. The World Organisation for Animal Health (OIE) and MARA, for example, indicated that there were about 5,000 dead pigs and 1 million pigs culled country-wide in 2018, and nearly 8,000 dead pigs and about 300,000 pigs culled country-wide in 2019. The drop in herd size could be significantly larger than the number of animal deaths alone would reflect; disease-related herd size reductions result from both animal deaths and changes in pig raising and breeding (i.e., production) activities. Although production activities were apparently reduced during the height of the ASF outbreak, the large difference between mortality and herd size reduction raises significant questions about the reliability of reported mortality estimates.

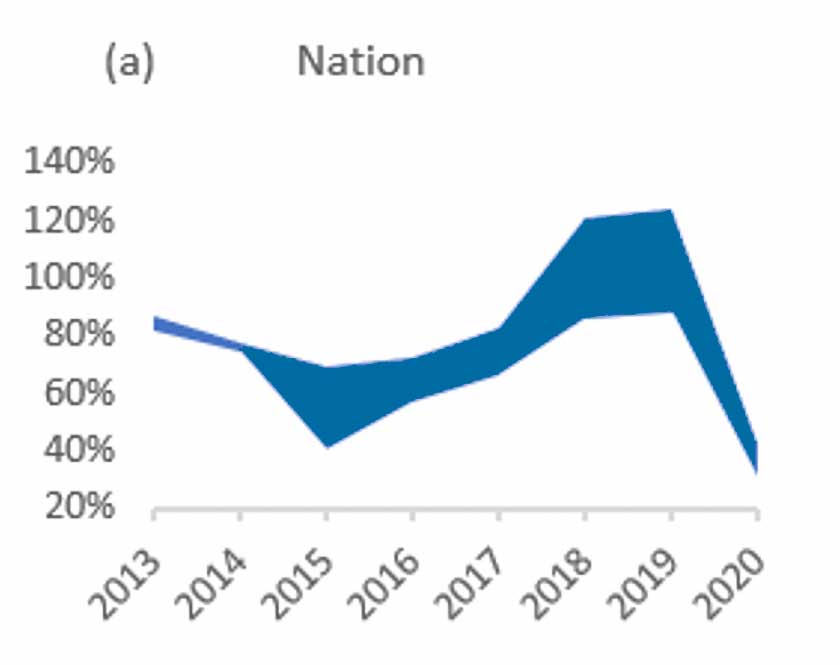

Insurance Industry Impacts

The insurance industry also experienced impacts from the ASF outbreak. Data from a sample of insurance companies whose portfolios cover nearly half of the agricultural insurance market (a sizable but incomplete sample whose biases are uncharacterized) indicate large losses from ASF in 2018 and 2019 in some provinces and nationwide, with loss ratios of more than 100% (Figure 4 ). We can compare the industry experience with MARA and OIE data by roughly estimating the loss ratio attributable to the animal deaths reported by OIE and MARA: 0.3% and 0.1% for 2018 and 2019, respectively (Table 1). In addition, if we assume the change in herd size (i.e., 25% reduction) is entirely due to ASF, we can look at the experience in a stochastic event of similar magnitude from the AIR MPCI Model for China, which has a loss ratio of 180%. We will discuss this estimate in more depth in later sections. Clearly, different data sources paint very different pictures of the financial impact due to ASF.

Explaining the apparent discrepancies among data sources is complicated by the fact that there is significant uncertainty associated with the responses of different stakeholders (e.g., farmers, insurers, and the government) to ASF, such as the degree of compliance with containment measures or the portion of the liability that insurers will pay out for culling. Consequently, the number of cases reported by OIE and MARA may be smaller than the actual number of cases.1–5

Estimating ASF Insurance Losses in China

Losses from ASF can be classified into two types: pigs with confirmed cases of ASF (both infected live animals and deceased animals); and pigs culled for biosecurity control. Incomplete and contradictory data, however, make estimating losses due to ASF challenging. To better understand the potential losses, we considered different data sets and multiple loss scenarios.

Insurance Loss Estimates Based on OIE- and MARA-Reported ASF Events

We first estimated the possible insurance losses due to ASF based on the reports of OIE and MARA by estimating the percentage of deaths and loss ratio by province and by pig type (i.e., breeding sow and feed pigs). To arrive at our estimate we combined reported ASF events with province policy terms for breeding sow and feed pigs, as well as estimates drawn from the AIR MPCI Model for China of the ratio of breeding sows to feed pigs by province. The total number of insurable breeding sows and feed pigs was obtained from the China Rural Yearbooks.

Our analysis indicated that the loss due to pigs culled for biosecurity control was dramatically greater than the loss due to pigs with confirmed cases of ASF. Note that the number of culled animals largely depends on the scale of livestock farming at the location of an ASF outbreak and the density of pigs and pig farms around it, which can vary significantly from case to case. Culled animals have special policy terms that account for a government indemnity subsidy. The percentage of deaths and losses of insurable pigs country-wide (both breeding sow and feed pigs) in 2018 and 2019 are shown in Table 1 .

| Year | Total Death Percentage | Loss Ratio |

|---|---|---|

| 2018 | 0.23% | 0.3% |

| 2019 | 0.06% | 0.1% |

Loss estimates for the same years for Sichuan and Henan (the top two provinces for pig production) and, for comparison, the provinces with the highest loss ratio for each year, are shown in Table 2 . At the province level, loss ratio estimates attributed to ASF were more than 10% only in Beijing in 2018 and in Hainan in 2019. These very small loss ratios appear discrepant with the actual experience of the livestock insurance market, which had higher-than-average loss ratios for pigs for these two years (Figure 4 ).

| Province | Year | Total Death Percentage | Loss Ratio |

|---|---|---|---|

| Beijing | 2018 | 6% | 39% |

| Henan | 2018 | 0.03% | 0.02% |

| Sichuan | 2018 | 0.06% | 0.02% |

| Hainan | 2019 | 2% | 11% |

| Henan | 2019 | 0.% | 0.% |

| Sichuan | 2019 | 0.002% | 0.005% |

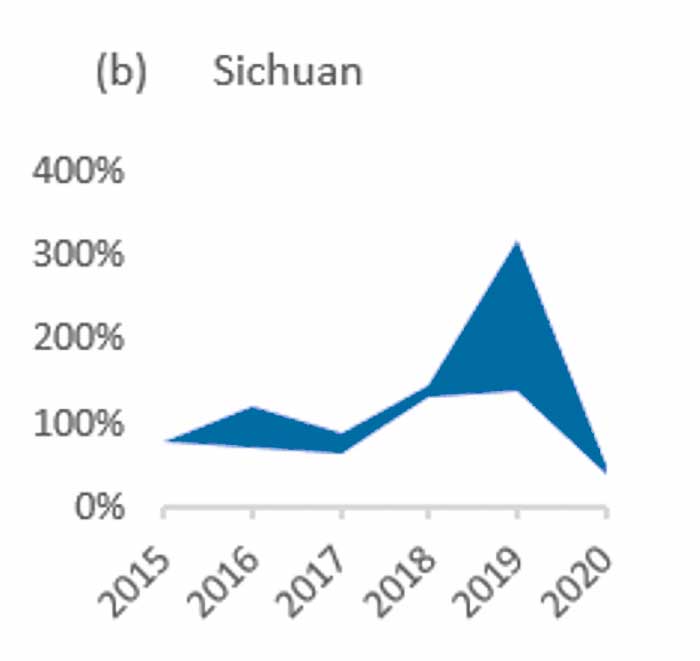

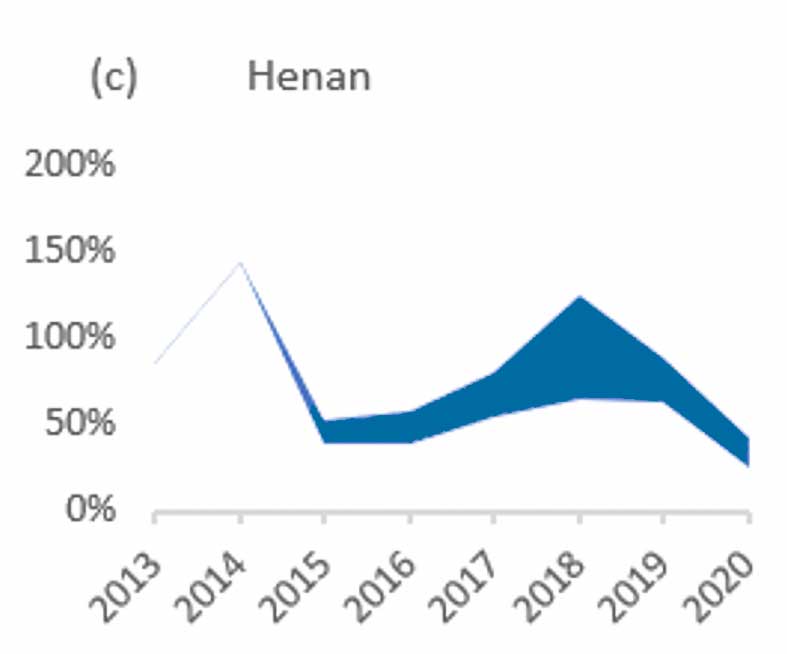

Insurance Loss Estimates Based on Insurance Industry Data

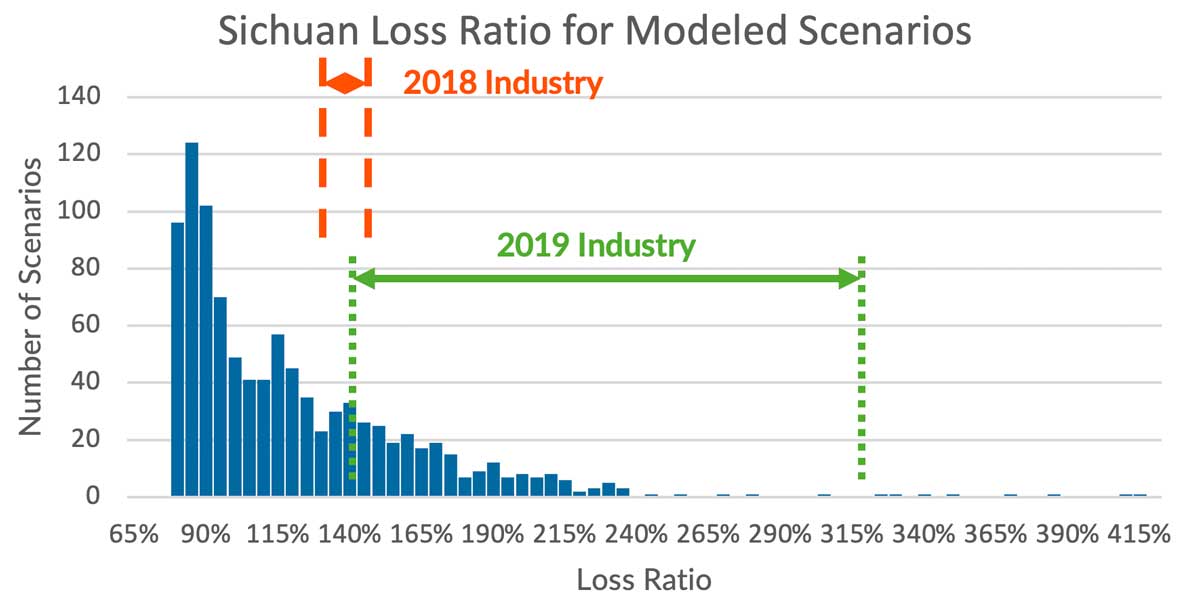

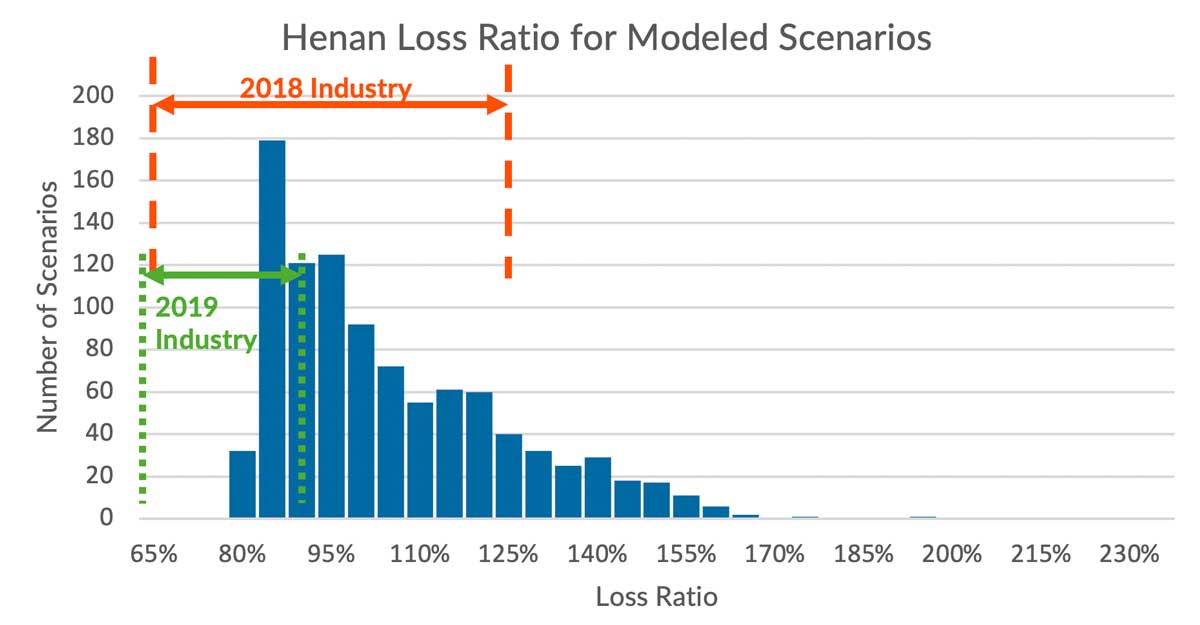

Based on insurance industry data, the total pig loss ratio for selected individual companies in 2018 and 2019 ranged between 75% and 125%, which is 10–60% higher than the historical average (Figure 4 a); however, there can be significant variation in loss ratio between provinces. For example, in Sichuan, the leading province for pig production, insurers experienced loss ratios of up to 320% in 2019 (Figure 4 b). Loss ratios also varied greatly among insurers. For example, in Henan (Figure 4 c), the range of insurer loss ratios was 65% to 125% in 2018.

Insurance Loss Estimates Using the AIR MPCI Model for China

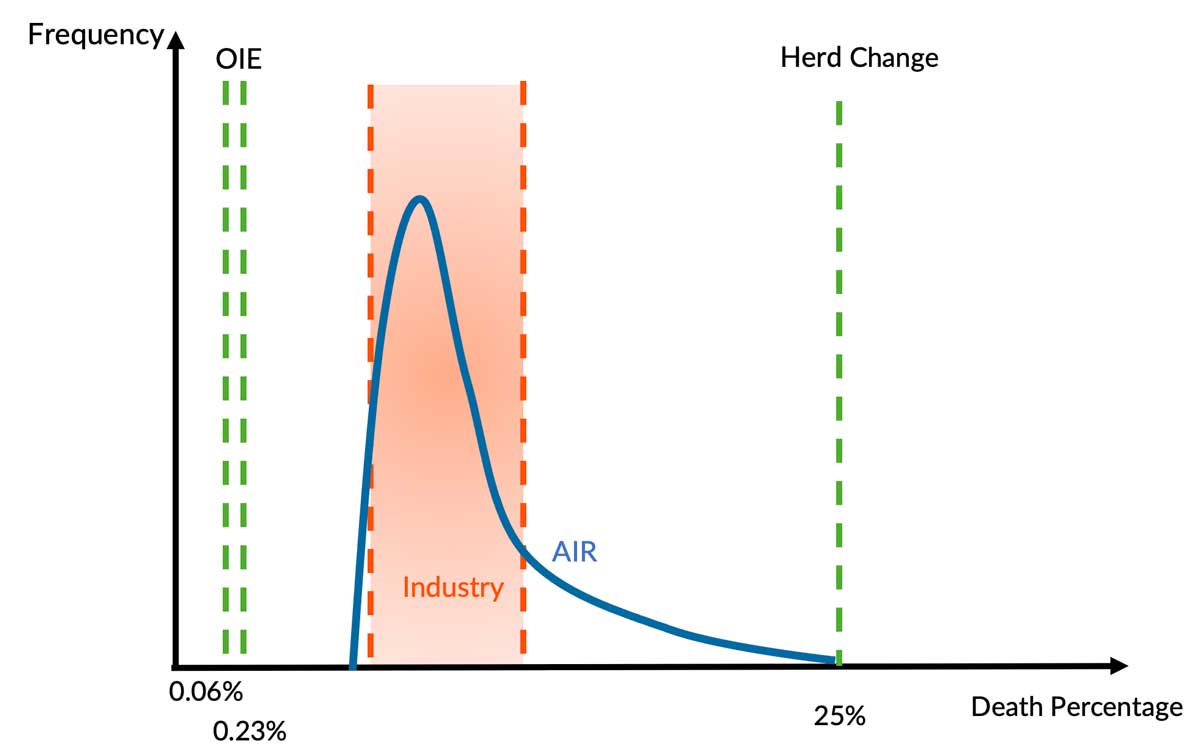

To estimate losses using the AIR MPCI Model for China, which models biotic and abiotic livestock perils, a range of similar events (years) in the AIR stochastic disease catalog was selected after examining the catalog of scenarios for insight into disease events for pigs and considering the uncertainties in the effects of protection measures and human activities on the number of animals and the geographic distribution of ASF impacts. The relationship between percentages of pig deaths estimated from OIE and MARA, size of herd change from MARA, and the selected AIR stochastic scenarios are shown in Figure 5. Also shown is the range of pig death percentages that correspond to the range of industry loss ratios from both 2018 and 2019 in the sample of insurance companies.

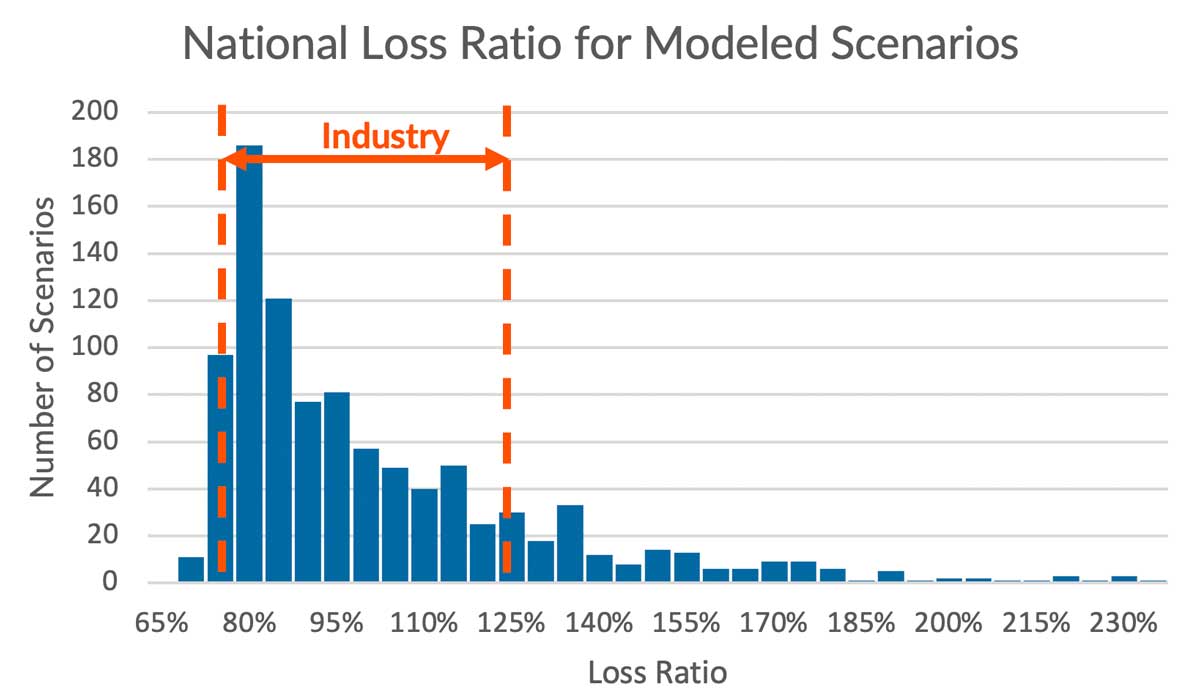

The selected AIR scenarios from the 10,000-year catalog consist of 980 events (years) with a percentage of pig deaths from disease ranging from 1% to 25%, encompassing the entire range of the available industry loss data and extending up to the herd size reduction (which is likely an overestimate of actual pig deaths). The range of scenarios does not extend to the very low estimates of deaths from MARA and OIE, as that would result in loss ratios that are lower than an average year. We estimated the total loss ratio due to both disease and weather for each event (year) based on the provincial policy conditions with government subsidy for culled pigs. The weather impact was kept fixed across scenarios by using the mean loss ratio due to weather impacts in the AIR model. For each selected similar stochastic event, Figure 6 shows the range and distribution of annual loss ratios, which range from 67% to 235%. The modeled estimates are in good agreement with the available industry loss ratios, which range from 75% to 125% in 2018 and 2019.

Using these AIR scenarios, we can also examine the results in individual provinces. The results for the provinces of Sichuan and Henan are shown in Figure 7. These modeled estimates show geographic differences in the risk (i.e., loss ratios that are relatively higher in Sichuan than in Henan), especially in the tail of high loss ratios. Modeled estimates at the province level are also in broad agreement with the available industry loss ratios of 130–145% in 2018 and 140–320% in 2019 for Sichuan and 65–125% in 2018 and 63–88% in 2019 for Henan. Each of the industry loss ratios in our sample, however, only represents a relatively small slice of the total insured exposure in the province; the model suggests that the losses for the entire province may be smaller than the upper range of sampled losses for Sichuan and larger than the lower range for Henan. In this manner, the AIR model can be used to interrogate real-life events on a provincial level using only aggregate, country-wide data.

Managing ASF Risk to Livestock in China

Even in this era of big data, we can see that recent events still have significant data uncertainties, leaving an opening for models to provide insightful and timely information. African swine fever in China’s pigs has led to significant impacts on pig herd numbers and pork prices. Inconsistencies in the data available, however, have complicated assessments and analyses of the impact of ASF on losses. The AIR MPCI Model for China offers a catalog of 10,000 loss scenarios that can be used to explore potential effects of ASF and other diseases on an insurance or reinsurance portfolio. Using AIR’s model, loss scenarios can be disaggregated from national to regional or extrapolated from regional to national. Event distributions drawn from the catalog of loss scenarios can offer a clearer understanding of the probabilities and distributions of loss.

References

1 Bao, J., Wang, Q., Lin, P., Liu, C., Li, L., Wu, X., ... & Wang, Z. (2019). Genome comparison of African swine fever virus China/2018/Anhui XCGQ strain and related European p72 genotype II strains. Transboundary and emerging diseases, 66(3), 1167-1176.

2 Gramig, B. M., Horan, R. D., & Wolf, C. A. (2005). A model of incentive compatibility under moral hazard in livestock disease outbreak response. Agricultural and Applied Economics Association Annual Meeting, July 24-27, Providence, RI.

3 Kuchler, F., & Hamm, S. (2000). Animal disease incidence and indemnity eradication programs. Agricultural Economics, 22(3), 299-308.

4 Gunarathne, A., Kubota, S., Kumarawadu, P., Karunagoda, K., & Kon, H. (2016). Is Hiding Foot and Mouth Disease Sensitive Behavior for Farmers? A Survey Study in Sri Lanka. Asian-Australasian Journal of Animal Sciences, 29(2), 280–287.

5 lbers, A.R.W, Gorgievski-Duijvesteijn, M.J, Zarafshani, K, & Koch, G. (2010). To report or not to report: a psychosocial investigation aimed at improving early detection of Avian Influenza outbreaks. OIE Revue Scientifique et Technique, 29(3), 435–449.

6 Yang, Q., Liu, W., & Chen, J. (2019). The current situation of African Swine Fever in China and the causes. China Collective Economy, 25, 163-165. (In Chinese)

7 Zhang, D., & Guo, Z. (2020). Prevention and control measures of slaughterhouses for African Swine Fever. Livestock and Poultry Industry, 31(12), 106-108. (In Chinese)

Yan Ge, Ph.D.

Yan Ge, Ph.D. Jie Song, Ph.D.

Jie Song, Ph.D.