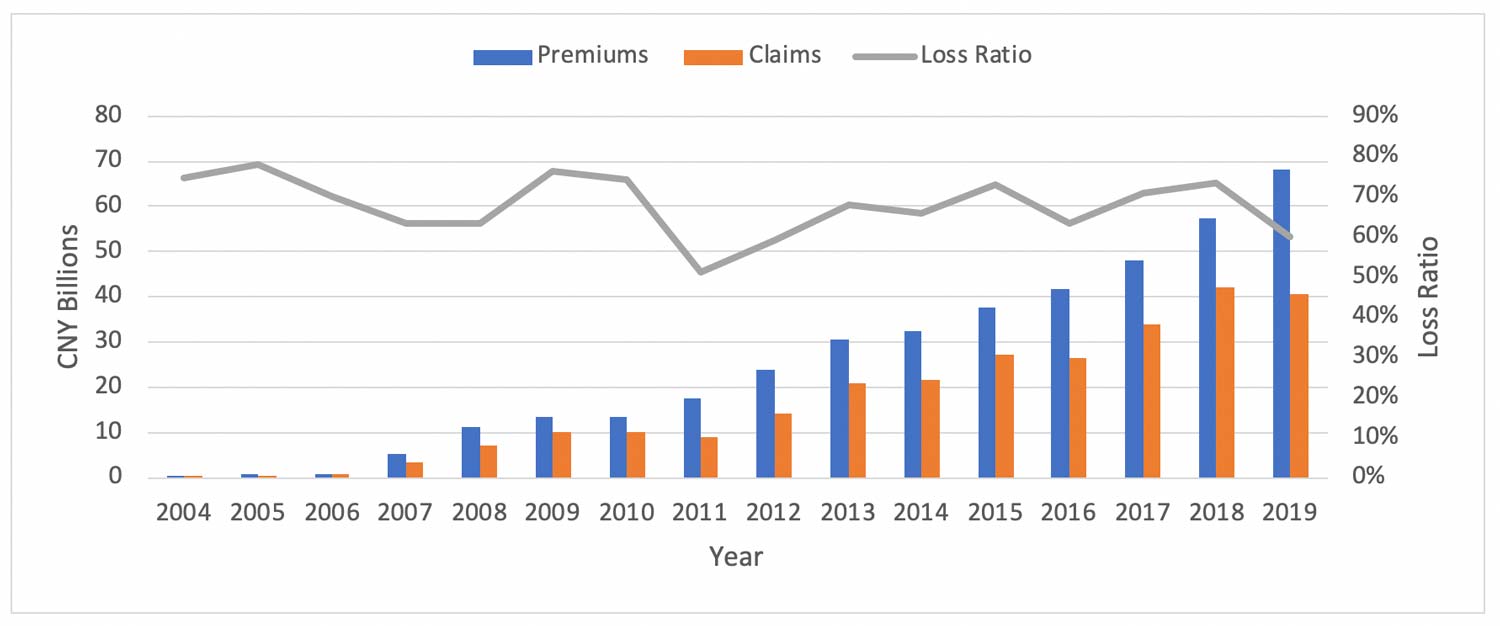

Agricultural insurance in China includes the crop, forestry, livestock, and aquaculture lines of business, and premiums have risen rapidly since 2007 (Figure 1) when the government-funded premium subsidies were expanded nationwide. This helped make China the second-largest agricultural insurance market in the world, yet detailed data on insured liability and premium are scarce and incomplete. This creates unique challenges to effectively and accurately quantifying agricultural risk in China.

Understanding China’s Agricultural Insurance Market

To assess agricultural risk in China, it is important to note that the central government subsidizes crops (including corn, rice, wheat, cotton, potato, oil crops, and sugar crops), forests, and livestock (including fattening pig, dairy cattle, and breeding sow), as well as some specialized localized types.

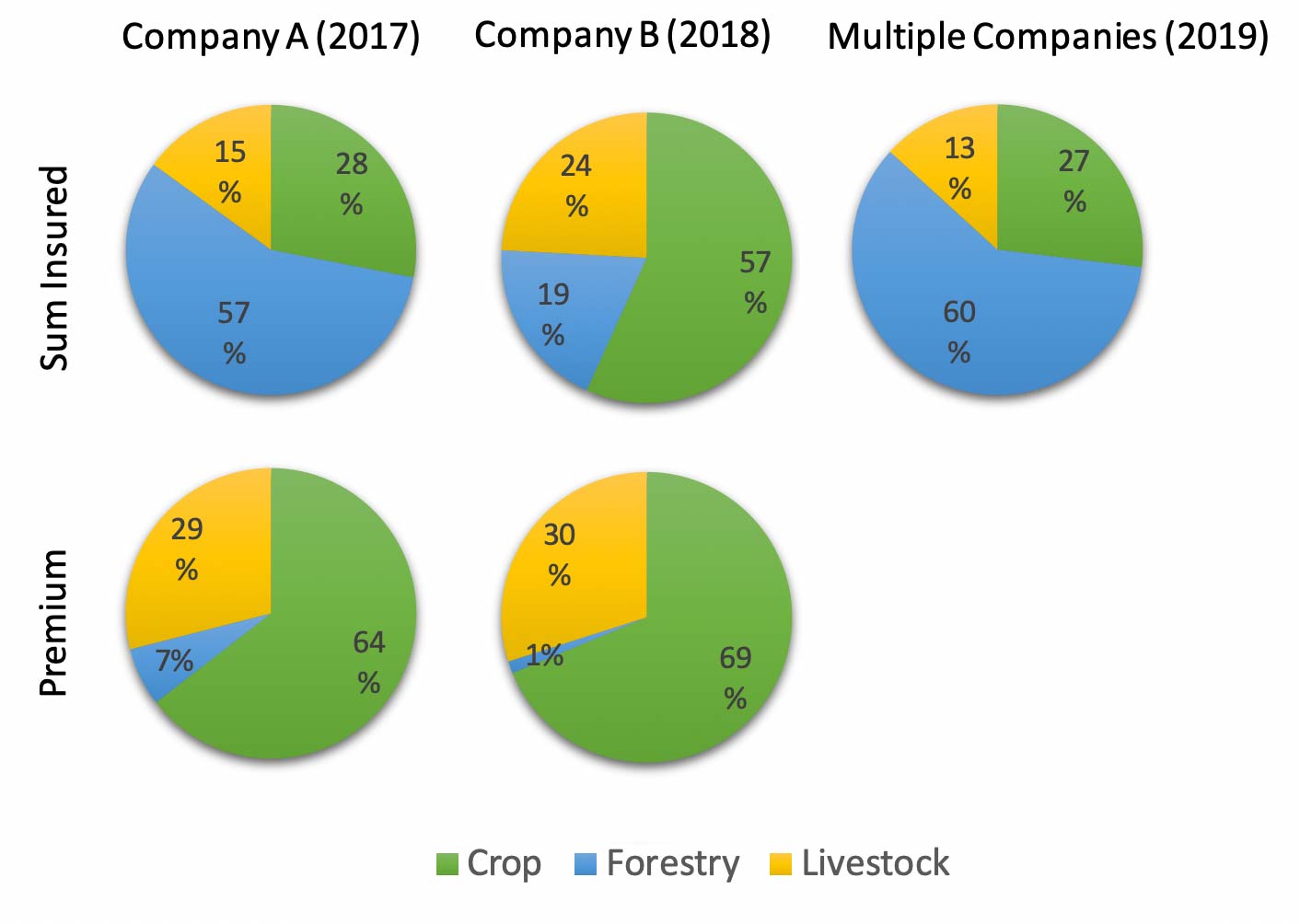

Figure 2 shows 2017 data from major insurance Company A, 2018 data from major insurance Company B, and 2019 data from multiple insurance companies, which accounted for more than 90% of the market liability that year. Although the share of crop, forestry, and livestock liability varies, the data show that while forestry represents the largest share of the liability, crop represents the largest share of the insurance premium; livestock accounts for about a quarter of the liability and premium, and aquaculture (not shown in the figure) only accounts for a small fraction of both the liability and premium. From the perspectives of liability and premium, any model designed to assess the risk to agricultural insurance in China should therefore cover crop, forestry, and livestock.

Crop Liability in China Varies Regionally

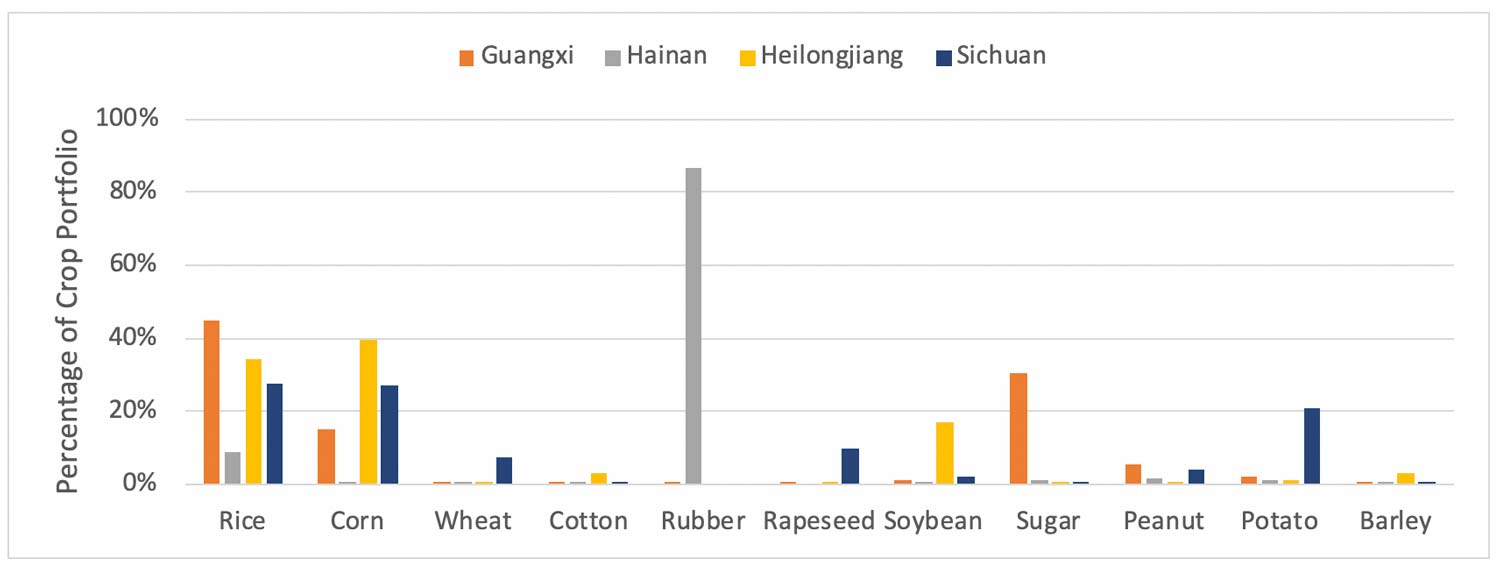

The market breakdown presented may seem simple, but because different crops require different growing conditions, the crops that make up most of the liability on the national scale may differ from those that constitute most of the liability at the provincial level.

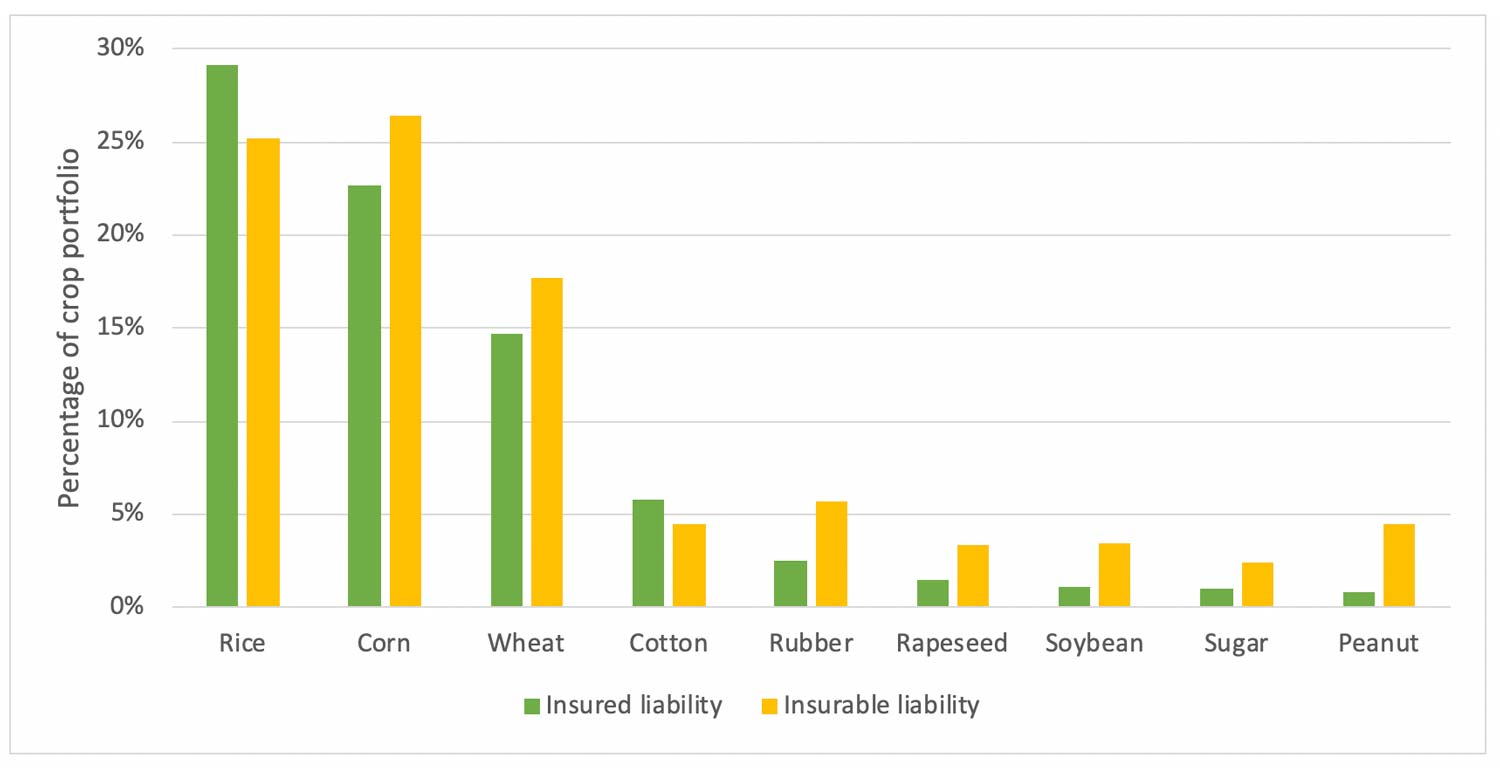

For example, Figure 3 shows the percentage of the nationwide insured liability for major crops for Company A in 2017 and for the modeled insurable liability in the AIR Multiple Peril Crop Insurance (MPCI) Model for China, indicating that rice, corn, and wheat make up about two-thirds of the liability.

At the provincial level, however, the percentage of liability for major crops in the modeled insurable crop portfolio varies by province (Figure 4). Of the selected provinces, Heilongjiang most resembles the nationwide portfolio while other provinces differ; for example, sugarcane in Guangxi, rubber in Hainan, and potato in Sichuan account for 30%, 86%, and 21% of the provincial total insurable crop liability, respectively. Understanding and accounting for the impact of regional variability of crops on insurance liability is, accordingly, necessary to effectively quantify and manage agricultural risk in China.

Modeling Agricultural Risk in China

The AIR MPCI for China reflects the differences in individual insurance programs, which can vary by province, enabling (re)insurers to better assess the risk and manage their portfolios. The scenario-based model enables the analysis and pricing of agriculture insurance and reinsurance treaties under China’s current MPCI program, considering both the latest policy conditions and terms as well as the regional variability of crops. It features a stochastic catalog of 10,000 simulated years that account for a range of loss scenarios—both common and rare—for crops (corn, cotton, rapeseed, rice, soybean, wheat, barley, peanut, potato, sugar, and rubber), forestry, and livestock (breeding sow, other pig, dairy cattle, other cattle, poultry, and sheep/goat). This includes all lines of business that have premiums subsidized by the central government, modeling the impact to the insurable exposure down to individual counties. Assessing agricultural insurance risk in China is complicated due to program changes, dramatic premium growth, evolving policy conditions, the regional variability of crops planted, and limited detailed historical data. AIR’s China MPCI model provides a realistic view of the agricultural risk in China’s growing market.

Learn more about the AIR Multiple Peril Crop Insurance Model for China