About Catastrophe Modelling

Both natural catastrophes— earthquakes, hurricanes, tornadoes, and floods—and man-made disasters, including terrorism and extreme casualty events, can jeopardize the financial well-being of an otherwise stable, profitable company. Catastrophe models are computer programs that mathematically represent the physical characteristics of natural catastrophes, terrorism, pandemics, extreme casualty events, and cyber incidents.

In the case of rare but severe events, historical loss information has proven unreliable in assessing future loss potential. AIR Worldwide developed probabilistic models that help organizations prepare for the financial impacts of catastrophes—before they occur. Today, organizations use AIR models to assess the likelihood and severity of loss from catastrophes in more than 110 countries worldwide.

Watch our video to learn how catastrophe modeling can help you estimate the economic impact of extreme events such as hurricanes, earthquakes, and floods to make residents, businesses, and communities more resilient.

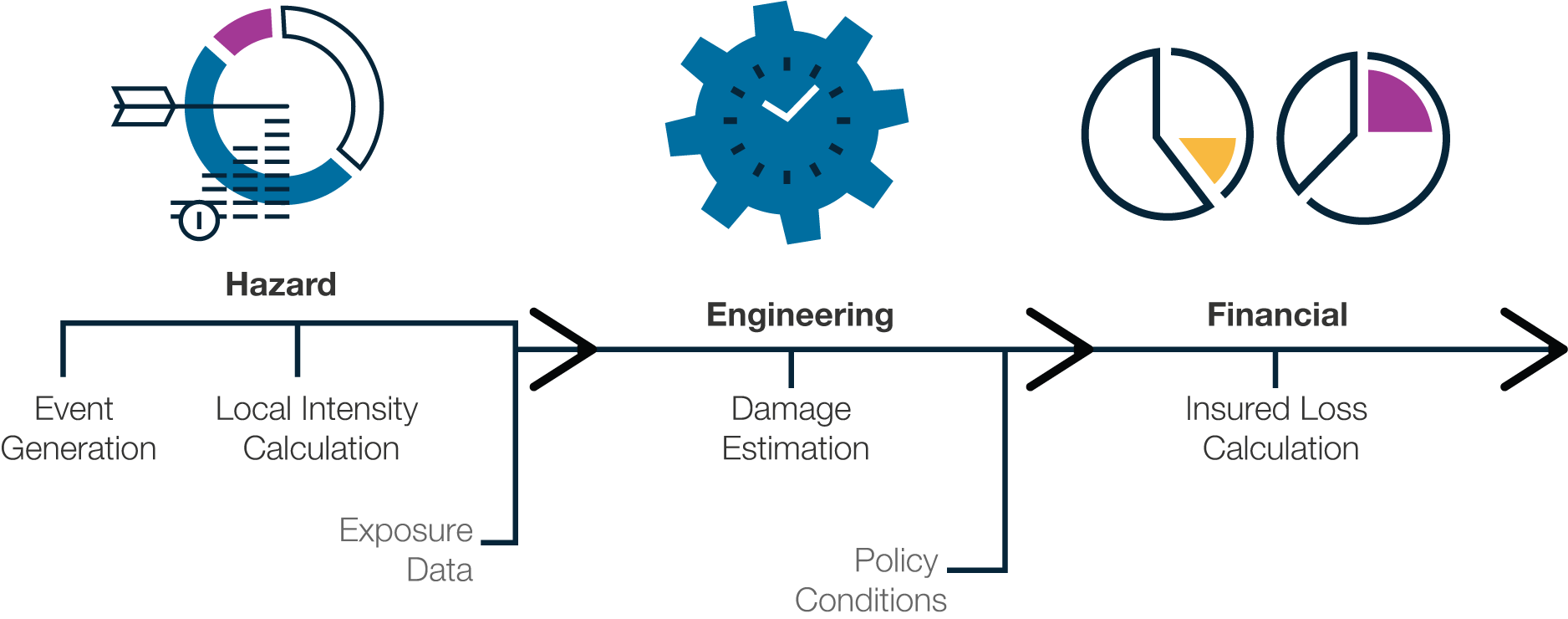

How Models Work

Built from the most current scientific data available, AIR models capture how catastrophes behave and impact insurable assets using sophisticated simulation methods. All AIR models are based upon a specialized framework:

- Event Generation: Large catalogs of simulated events capture the frequency, severity, location, and other characteristics of the entire spectrum of plausible catastrophes

- Local Intensity Calculation: For each simulated event, the intensity of the hazard is calculated at each affected site

- Exposure Data: Information about the property, replacement value and physical characteristics, is input into the model

- Damage Estimation: Physical damage is calculated for each affected exposure

- Insured Loss Calculation: Policy terms and conditions are applied to estimate insured losses

What AIR Models Provide

Detailed output from AIR models is the basis for understanding and quantifying catastrophe risk. It is the "currency" by which risk is priced, transferred, and traded, and applications today go far beyond those within the insurance industry. Critical metrics produced by AIR models include:

Average Annual Loss (AAL)

The loss that can be expected to occur per year, on average, over a period of many years

Exceedance Probability (EP)

The likelihood that a loss of any given size (or greater) will occur in the coming year

Tail Value at Risk (TVaR)

The expected value of loss beyond a specific exceedance probability

AIR Model Validation

AIR models undergo a continual process of review, refinement, enhancement, and validation. AIR's rigorous validation process is not limited to just the final model results. Throughout the model development process, every component is individually verified against historical data to ensure a realistic representation of the physical phenomena. In addition, AIR elicits independent peer review and expert judgement to ensure that the models capture the full range of potential future catastrophe experience, including the most extreme events that may not have occurred historically.