How Coastal Wind Insurance Pools Can Own the Risk

Aug 21, 2013

Editor's Note: AIR launched its Public Risk Services group in April. Headed by Vice President John Rollins, the group's mission is to help legislators, regulators, wind and earthquake pools, federal insurance programs, quasi-governmental organizations, and other members of the public sector better understand and manage catastrophe risk. This AIR Current describes how wind pool risk is increasing and steps wind pool managers can take to reduce it, and it offers insights into the enterprise risks private insurers face from the increased wind pool risk.

Coastal wind insurance pools in the United States are chartered by states to provide property insurance to residents and businesses that cannot secure private insurance with sufficient coverage at rates they consider affordable. Some "wind pools" cover only wind losses, while others offer a multi-peril policy. Indeed, multiple pools can coexist in the same state. Rates vary by pool, region, and policy type, and they are often below actuarially sound levels. Wind pools in states along the Atlantic coast have grown in recent years—sometimes dramatically—yet few have enough capital (either retained or by way of reinsurance) to satisfy their potential obligations. This under-capitalization is an enormous, but not intractable, issue facing not only managers of wind pools but also private insurers.

The issue arises because wind pools' deficits are usually ultimately recouped via one or more "assessment" mechanisms that levy charges on a broad swath of the state's private insurance policyholders. Private insurers subject to the assessment process face myriad enterprise risks, all dependent on how well the assessing pools manage their catastrophe risk. Therefore, it is imperative that all stakeholders understand the catastrophe risk management issues facing wind pools and their governing bodies.

Coastal Exposure Growth Increasing Risk

The overall insured value of exposures in coastal areas is growing, and the growth shows no sign of stopping. Table 1, adapted from AIR's report, Coastline at Risk, shows residential and commercial coastal exposure (defined as exposure located in coastal counties) valued at year-end 2004, 2007, and 2012 as well as the implied growth rates.

| Estimated Value of Insured Coastal Property (USD Billions)* |

Annual Growth Rate | ||||

| State | |||||

| 2004 | 2007 | 2012 | 2004-2007 | 2007-2012 | |

| Alabama | 76 | 93 | 118 | 6.8% | 5.0% |

| Connecticut | 405 | 480 | 568 | 5.8% | 3.4% |

| Delaware | 47 | 61 | 82 | 9.2% | 6.2% |

| Florida | 1,937 | 2,459 | 2,862 | 8.3% | 3.1% |

| Georgia | 73 | 86 | 107 | 5.5% | 4.5% |

| Louisiana | 209 | 224 | 294 | 2.3% | 5.5% |

| Maine | 117 | 147 | 165 | 7.9% | 2.3% |

| Maryland | 12 | 15 | 17 | 7.2% | 3.0% |

| Massachusetts | 662 | 773 | 850 | 5.3% | 1.9% |

| Mississippi | 45 | 52 | 61 | 5.0% | 3.2% |

| New Hampshire | 46 | 56 | 64 | 6.8% | 2.8% |

| New Jersey | 506 | 636 | 714 | 7.9% | 2.4% |

| New York | 1,902 | 2,379 | 2,923 | 7.7% | 4.2% |

| North Carolina | 105 | 133 | 164 | 8.0% | 4.2% |

| Rhode Island | 44 | 54 | 58 | 7.3% | 1.5% |

| South Carolina | 149 | 192 | 239 | 8.8% | 4.5% |

| Texas | 740 | 895 | 1,175 | 6.5% | 5.6% |

| Virginia | 130 | 159 | 182 | 7.0% | 2.8% |

| All Above States (Coastal Only) | 7,204 | 8,891 | 10,642 | 7.3% | 3.7% |

| Total U.S. (Coastal and Non-Coastal) | 43,656 | 53,495 | 64,624 | 7.0% | 3.9% |

Coastal exposures grew at similar or greater rates than overall exposures in most states during both the housing boom of 2004-2007 and the bust of 2008-2012, surpassing USD 10 trillion in insured value in 2012. During the boom, exposures grew by roughly 7% annually, a pace that implies a doubling of catastrophe exposure every 10 years. Despite the Great Recession of 2008-2009 and anemic recovery since, insured values (driven by replacement costs, not market values) still grew at a nearly 4% annual rate in the Atlantic coastal states.

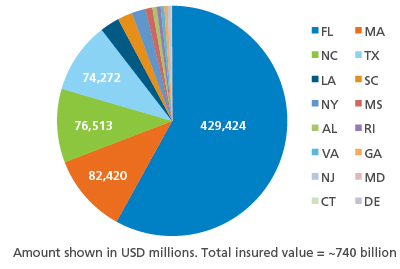

The share of this risk insured by wind pools has grown. Figure 1 shows the exposure levels recently publicly reported by most of the state wind pools.

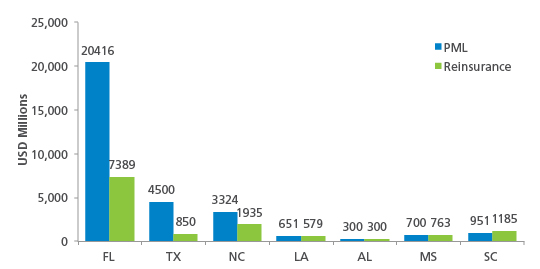

The exposure growth has driven increased catastrophe risk. Figure 2 shows storm risk as measured by the 1% occurrence exceedance probability loss amount, or "100-year probable maximum loss (PML)," recently reported by select large pools side by side with the limits of reinsurance purchased by each pool for the 2013 hurricane season.

Florida represents the majority of the risk, yet other states also contribute billions of dollars to U.S. wind pool risk. Although PMLs are not additive across states, Figure 2 illustrates that a hurricane season with well over USD 20 billion in countrywide wind pool losses is possible.

Who Pays for Underfunded Wind Pools?

Although wind pools accumulate surpluses in storm-free years, much of the risk in states such as Florida, Texas, and North Carolina, is still not properly funded through either surplus or risk transfers such as reinsurance. In contrast, as Figure 2 indicates, South Carolina buys reinsurance to limits in excess of its 100-year PML.

Just one hurricane could cause an annual deficit (defined as negative year-end net worth) in a state's underfunded pool. As Florida's experience in 2004 proved, many storms in a single season are possible as well. Under state laws, deficits are mostly eliminated by assessments levied against insurance companies, policyholders, or both. Because insurers generally have the right to recoup assessments by adding surcharges to premiums, policyholders essentially fund nearly the entire deficit. In some states, the "assessment base," or universe of premiums to which an assessment applies, is much broader than just the wind pool's policies; it may include policies for all property lines, or even nearly all policies in the state (personal and commercial lines, property and liability lines). The impact of wind pool assessments manifests itself in myriad enterprise risks for affected insurers (see callout).

Catastrophe Models Can Help Wind Pools and Insurers Own Their Risk

Due to their public governance and high-profile responsibilities, wind pools face unique challenges, including relaxed underwriting standards, pricing constraints, greater reporting demands, and the increasing need to transfer risk to the capital markets. All these challenges can be addressed head on with in-house catastrophe models used by well-trained staff.

Wind pools have more relaxed underwriting standards, which reflect their status as markets of last resort. These portfolios have high coastal concentrations, high and variable average replacement values, and diversity in construction types. Accurate representation of potential catastrophe losses is critical for wind pools, and reliable catastrophe loss and funding estimates begin with high quality exposure data—including a thorough knowledge of the property-level attributes that drive catastrophe risk (see "Florida's Citizens'" callout). Better data quality also allows wind pools to better market blocks of policies to private insurers as part of removal programs commonly called "takeouts" or "depopulations."

In addition to relaxed standards, wind pools are constrained in pricing, as their governing stakeholders may see them as instruments that ensure "affordable" coastal insurance. However, rate levels perceived as affordable are often below actuarially sound values. Yet even when the sound rate cannot be charged, it is important to communicate the proper benchmarks to stakeholders. Although models do not produce rates as output, models do provide critical risk assessment metrics for use in ratemaking, especially for coastal properties that have high loss costs and contribute greatly to the cost of capital embedded in reinsurance prices. Pool managers and governing stakeholders make better decisions when the prices likely to prevail in an open or private market for the same risks are acknowledged. There is no substitute for using catastrophe models to determine these prices, as model output has become a currency for understanding and quantifying risk in insurance and reinsurance transactions. (Please read "Catastrophe Models: The Currency for Transferring Risk" for more on this subject.)

Another challenge wind pools face is the need to report to more stakeholders on a more frequent basis than private insurers do. Reporting requests are often urgent, high-priority, and require model results. Internal staff expertise and access to models drives responsiveness and builds credibility with those who ultimately determine many aspects of the pool's fate.

Finally, wind pools are increasingly seeking to transfer their risk to the capital markets, sponsoring "catastrophe bonds" that securitize the risk and transfer it to global investors. A critical component of cat bond offerings is the expert analysis provided by a designated loss calculation agent, which is always a catastrophe modeling firm. A thorough knowledge of catastrophe modeling helps wind pools attract investors and design securities that close their funding gaps with minimal "basis risk"—the risk that entitled recoveries after a storm do not reflect incurred losses to the pool.

Regardless of whether the pools conduct in-house modeling, given the many distinct risks to insurers arising from assessments, private insurers should make wind pool assessment risk an integral portfolio management consideration. (Please read "Managing Wind Pool Risk with Portfolio Optimization" for an in-depth discussion of solutions for insurers and reinsurers.)

Closing Thoughts

Insurers have used catastrophe models for decades to manage their privately insured portfolios. Now, the growing coastal hurricane risk, the increasing share of that risk insured by publicly backed wind pools, and continuing assessment practices are exposing insurers to additional financial and enterprise risks. Wind pools can reduce the risk passed on to the private insurance system by investing in catastrophe modeling resources and talent, listening to the expert guidance and modeling experience of private insurers, and applying modeling best practices across their operations and financing activities.

By: John Rollins, FCAS, MAAA

By: John Rollins, FCAS, MAAA