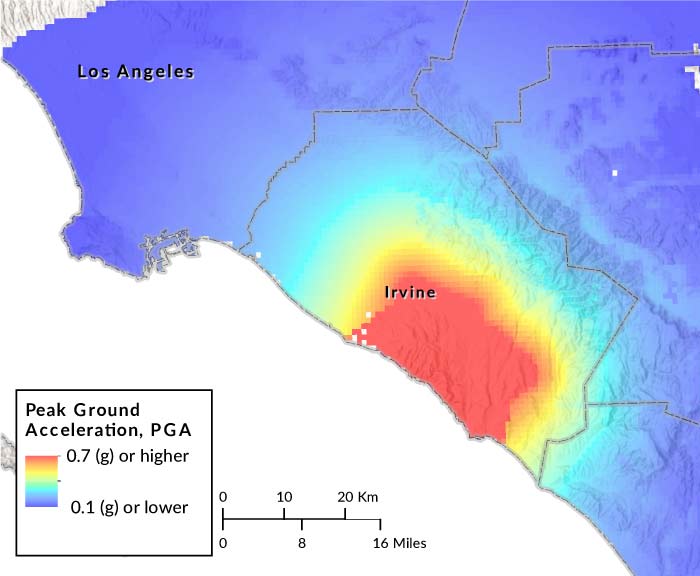

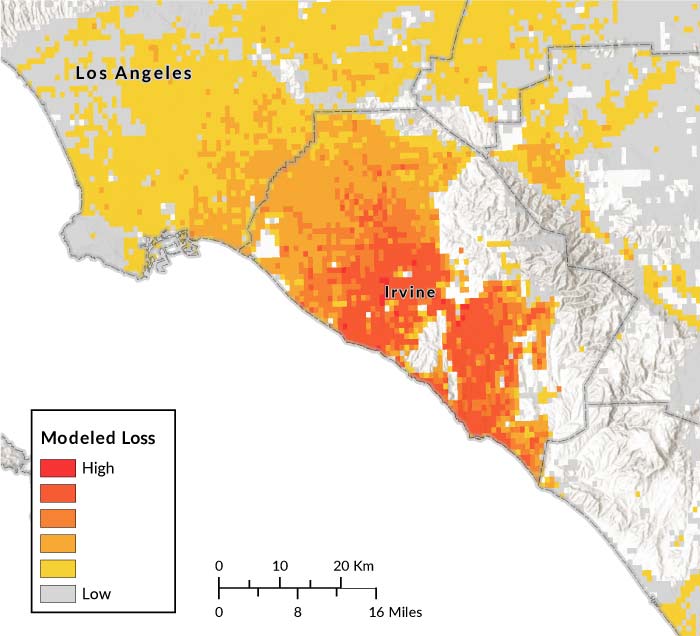

How would this M6.7 earthquake impact the ILS market?

A major earthquake striking Orange County—or any metropolitan area in California—would prompt immediate activity in the marketplace for insurance-linked securities (ILS): catastrophe bonds, industry loss warranties, sidecars, and collateralized reinsurance. To project potential ILS losses for catastrophic events, AIR, the leading modeling firm in the ILS market, builds and maintains a detailed catastrophe bond database containing all bonds currently on-risk, representing approximately USD 29 billion of outstanding principal.

For this M6.7 earthquake on the San Joaquin Hills Fault, we project a total loss to the cat bond market principal of USD 2.6 billion. Of the catastrophe bonds currently in the market, 13 would be impacted.

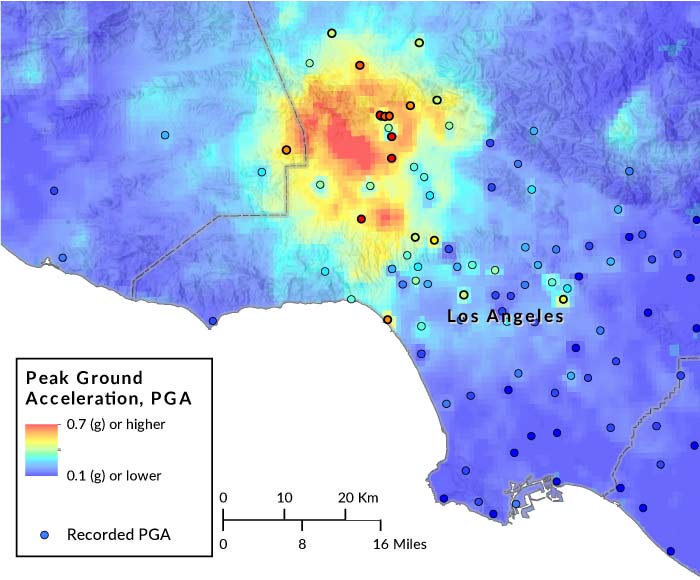

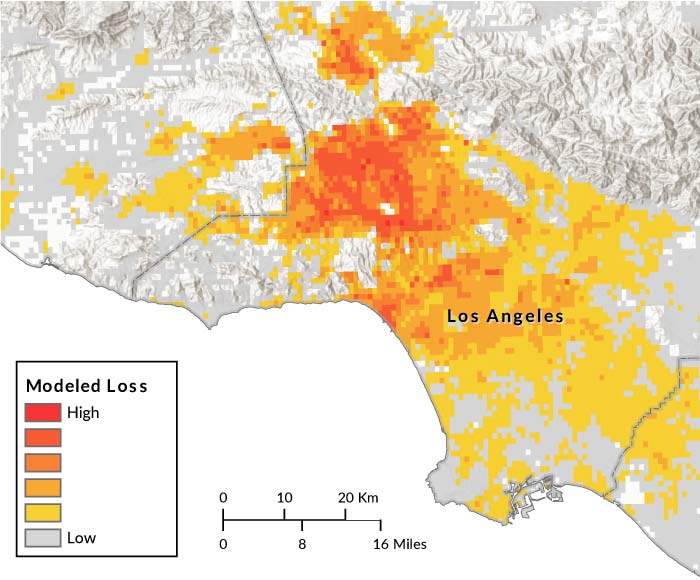

1 Modeled losses for the Northridge earthquake today and for an M6.7 earthquake striking Orange County (shown elsewhere on this webpage) are based on today’s building inventory. The losses assume that 20% of shake losses to homes are insured against shake damage but that only 17% of small businesses and large commercial properties are covered. The loss estimates include the expected increases in the costs of labor and materials necessary to repair or rebuild properties in the aftermath of a large earthquake. The loss for the stochastic event is for buildings and contents damage and loss of use (i.e., time element which is a result of business interruption or additional living expenses due to relocation costs or temporary lodging). considering all the contributing sub-perils of ground shaking, fire following, liquefaction, landslide, and sprinkler damage.

* Map Sources: Esri, USGS, NGA, NASA, CGIAR, N Robinson, NCEAS, NLS, OS, NMA, Geodatastyrelsen, Rijkswaterstaat, GSA, Geoland, FEMA, Intermap and the GIS user community