TRIPRA 2015: What’s Changed and How It Affects the Industry

Mar 19, 2015

Editor's Note: Earlier this year, the Terrorism Risk Insurance Act (TRIA) was reauthorized for a third time. This article examines the continued need for the federal backstop as well as the structural changes made to this latest iteration of the program.

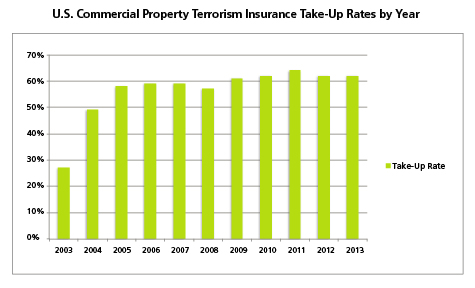

First passed into law in 2002, the Terrorism Risk Insurance Act (TRIA) requires commercial insurers to make terrorism insurance coverage available. Since then TRIA has established a federal backstop program, providing the necessary stability to the private terrorism risk insurance market by guaranteeing both the availability and affordability of terrorism insurance coverage for U.S. commercial properties and businesses. Around the same time that TRIA was first introduced, terrorism risk models also emerged in the market, enabling insurance industry stakeholders to better understand their exposure to this risk. Since 2003, take-up rates for commercial property terrorism insurance coverage have risen from less than 30% to just above 60%. Prices for terrorism risk insurance have also steadily dropped over the years as a result of the federal backstop program and also due to improved terrorism risk modeling capabilities.

The initial intent of TRIA was to provide a temporary federal backstop program that would allow the economy to recover following the 9/11 attacks. While the re/insurance industry has become increasingly willing to cover terrorism risks over the years, the private market still cannot assume all the risk alone. In the absence of TRIA, the capacity required to cover all the risk would lead to increased prices, making it difficult to obtain adequate coverage in terror-prone areas. With global terrorist organizations such as ISIS, al-Shabaab, and al-Qaeda in the Arabian Peninsula (AQAP) continuing to make headlines calling for attacks against Western interests, there remains the potential for a catastrophic terrorist attack on U.S. soil. For these reasons, the debate on the future of TRIA has continued. In early 2015, Congress answered the calls from the insurance industry and many other business sectors across the country by reauthorizing the federal backstop program for a third time—but with material changes.

The threat of global terrorism continues to rise. Learn more about the AIR Model for Terrorism.

Overview of TRIPRA 2015 Changes

For the first time since TRIA was passed, the program was allowed to lapse briefly at the start of 2015. The 11-day lapse of the program is expected to have minimal impact on the insurance industry, as many anticipated the program's reinstatement. Congress moved quickly at the start of the new year to reauthorize the program, and on January 12, 2015, President Obama signed H.R. 26, the Terrorism Risk Insurance Program Reauthorization Act of 2015 (TRIPRA 2015) into law, which extends the federal backstop program for an additional six years through December 31, 2020. As was the case with the prior reauthorization in 2007, TRIPRA 2015 calls for new structural changes to be implemented, which reduce the federal role in the program. (For a snapshot comparison between TRIPRA 2007 and TRIPRA 2015, please refer to this table.)

Minimum Threshold and Certification

Similar to the TRIPRA 2007 program, TRIPRA 2015 requires certain criteria to have been met before federal coverage under the program begins. First, P&C insurance losses resulting from a terrorism-linked attack must meet the minimum damage certification level of USD 5 million. If losses are expected to meet this minimum threshold, then the event must also be officially certified as an "act of terrorism." This certification is determined by the U.S. Secretary of the Treasury in concurrence with the Attorney General of the United States and—new under TRIPRA 2015—the U.S. Secretary of Homeland Security. As an example, insured losses resulting from the Boston Marathon bombing were not expected to meet this minimum threshold, and the event has not been certified as an act of terrorism—even though President Obama referred to it as an act of terrorism during a speech he gave soon afterward. The certification requirement can be frustrating for policyholders, who are left wondering when or if their claims will be covered.

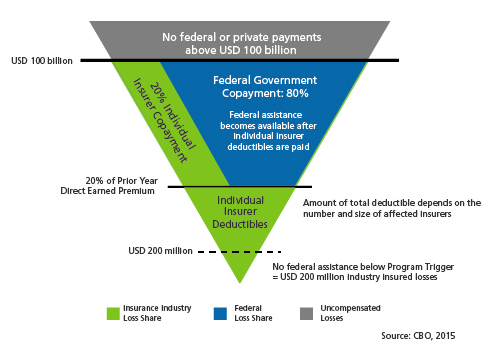

Program Trigger

If an act of terrorism has been officially certified, then compensation under the program will still not begin until aggregate insured losses in a calendar year reach the "program trigger." Under TRIPRA 2015, the program trigger will gradually be raised each year from USD 100 million in 2015 to USD 200 million by 2020. The increase to the program trigger is considered to be one of the most substantial changes to the program and aims to transfer more of the risk to the private insurance market. Some argue that this may negatively impact the solvency of small, insufficiently diversified insurers who are not well positioned to absorb losses up to this level.

Insurer Share of Terrorism Losses

Once all the initial criteria for federal coverage have been met, an insurer who incurs losses resulting from a certified act of terrorism is required to first cover a portion of the losses—the insurer deductible. The amount of each individual insurer's deductible is calculated as 20% of the insurer's direct earned premiums in TRIPRA-eligible lines of business for the previous calendar year. For losses in excess of the insurer deductible, each insurer is also required to cover a pro-rata share of the losses, or copayment, with the federal government providing compensation for the remaining losses. Under TRIPRA 2015, the insurer copay will gradually increase each year from 15% ultimately to 20%.

The annual cap on liability also still applies under TRIPRA 2015, which means that no federal or private insurer payments are compensated for any portion of aggregate industry insured losses exceeding USD 100 billion. TRIPRA 2015 also increases the industry annual aggregate retention from USD 29.5 billion to USD 37.5 billion in 2019, the fifth and penultimate year of the program. In 2020, the final year of TRIPRA 2015, the retention will rise to an amount equal to the average of all participating insurers' deductibles over the previous three program years. The Congressional Budget Office (CBO) has estimated that this amount could be as much as USD 50 billion.

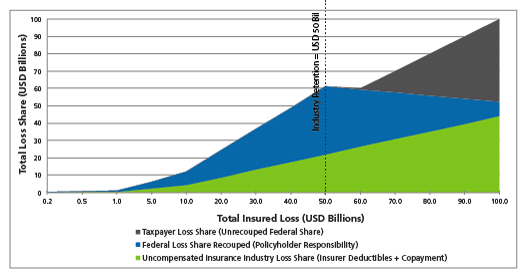

Insured Loss Sharing Under TRIPRA 2015

TRIPRA 2015 creates a public-private partnership for the sharing of insured losses resulting from a certified act of terrorism. Figure 3 examines how a range of loss levels are likely to be shared among the insurance industry, policyholders, and the federal government under the terms that will be in effect in 2020, the last year of the program.

Note that the actual loss sharing is dependent on the total amount of the insurer deductibles—which is difficult to predict without knowing the number and size of the impacted insurers. For this reason, for each of the total insured loss sizes shown in Figure 3, the total amount of the insurer deductibles was simply assumed to be 30%, but not more than USD 50 billion, which is an estimate of the total deductible for all insurers participating in the program during the year 2020.

According to TRIPRA 2015, the industry retention for the year 2020 will be set equal to the average of the insurer deductibles over the previous three program years, or USD 50 billion according to the CBO estimate. Keep in mind that until the uncompensated insurance industry loss share, (i.e., deductibles and the 20% insurer copayment) reaches the industry retention of USD 50 billion, the federal government will recoup at least a portion of their loss share through P&C policyholder surcharges in the years following the certified act of terrorism (taxed at a rate of 140%).

While it is always at the discretion of the Secretary of the Treasury to determine if additional recoupment is necessary after the industry has met the retention, it is assumed in this example that only the mandatory recoupment amount will apply. Any portion of the federal loss share that is not recouped will ultimately become the responsibility of taxpayers. Taxpayers and policyholders are also at risk of becoming responsible for any losses above the annual cap of USD 100 billion—which can result from the more extreme terror attack scenarios. While these extreme terror attack loss scenarios are remote, the AIR Terrorism Model contains events in the stochastic catalog that produce losses well in excess of USD 750 billion (for the commercial property and workers' compensation lines of business combined).

Calculating the Insurance Industry Retention and Mandatory Recoupment Amount

The mechanism for recouping the initial federal loss share is complex. Table 1 provides examples of the calculations for a few given loss sizes. For these calculations, the TRIPRA program terms for 2020 are in effect, including the potential USD 50 billion industry retention (as estimated by the CBO). Since the total of the insurer deductibles will depend on the number and size of the impacted insurers, for this example, the total of the insurer deductibles was assumed to be 30% of the total insured loss size, for simplicity.

| A | B | C | D | E | F | G | H | I |

| Assume = 30% loss | (A-B)x20% | B+C | (A-B)x80% | MIN(A, USD 50 bil) | F-D | Gx140% | MAX(E-H,0) | |

| Total Insured Loss (USD Billions) | Insurer Deductibles | Insurer Copay | Uncompensated Insurance Industry Loss Share | Federal Loss Share | Insurance Industry Aggregate Retention | Mandatory Recoupment Amount | Federal Loss Share Recouped (Policyholder Responsibility) | Federal Loss Share Unrecouped (Taxpayer Responsibility) |

| 25 | 7.5 | 3.5 | 11 | 14 | 25 | 14 | 19.6 | 0 |

| 50 | 15 | 7 | 22 | 28 | 50 | 28 | 39.2 | 0 |

| 75 | 22.5 | 10.5 | 33 | 42 | 50 | 17 | 23.8 | 18.2 |

The amount of the mandatory recoupment is calculated as the difference between the total industry insured losses (column A), up to the annual industry retention amount (Column F), and the total amount paid by the insurance industry through its deductibles and co-payments (Column D). The total recoupment amount is collected through a surcharge across all commercial P&C policyholder premiums in the years following the attacks. TRIPRA 2015 also increases the premium fee from 133% to 140%—meaning the total amount of the federal loss share recouped, or repaid, (Column H) is 140% of any mandatory recoupment amount (Column G). Any portion of the initial federal loss share that is not recouped ultimately becomes the responsibility of the taxpayers (Column I).

Managing Terrorism Risk

More than a decade after 9/11, terrorism remains a highly dynamic threat capable of causing significant insurance losses. The AIR Terrorism Model can be used in many ways in AIR's Touchstone platform and can be used to generate a clear picture of overall exposure to terrorism risk. AIR's probabilistic terrorism model in Touchstone employs a 500,000-year catalog of potential attack scenarios and their associated frequencies to yield full probability distributions of loss. Terrorism exposure accumulations can also be monitored through ring analysis via Touchstone's Geospatial Analytics Module. Lastly, Touchstone includes the capability to create custom deterministic terror loss scenarios, where each attack can be defined based on user-selected targets and weapon types. These comprehensive solutions allow risk managers to view a range of high-frequency and low-frequency losses and enable comparisons of alternative underwriting strategies and portfolio constructions to more fully and accurately estimate their exposure to terrorism risk. In addition, clients can model the impact of the TRIPRA 2015 program changes for pricing and reinsurance purchasing considerations.

114th Congress (2015-2016). H.R. 26 - Terrorism Risk Insurance Program Reauthorization Act of 2015. Retrieved from https://www.congress.gov/bill/114th-congress/house-bill/26

Congressional Budget Office. (2015). Federal Reinsurance for Terrorism Risk: An Update. Retrieved from https://www.cbo.gov/sites/default/files/cbofiles/attachments/49866-TRIA.pdf

Marsh. (2014). 2014 Terrorism Risk Insurance Report. Retrieved from http://www.insureagainstterrorism.org/Marsh2014TerrorismRiskInsuranceReport.pdf

Webel, Baird, Congressional Research Service. (2014). Terrorism Risk Insurance: An Issue Analysis and Overview of the Current Program. Retrieved from https://fas.org/sgp/crs/terror/R42716.pdf

By: Alissa Legenza

By: Alissa Legenza