Summer Floods in the UK: Comparing 2012 and 2007

Nov 26, 2012

Editor's Note: Senior Client Services Associate Thomas Hughes, from AIR's London Office, and Science Writer Sara Gambrill compare the UK summer floods of 2007 and 2012 and what the future may hold for the UK in terms of flood defense and insurance coverage.

Rain fell in record amounts in the UK from May through July 2007, causing major flooding in late June and again less than a month later. Insured losses totaled about GBP 3 billion. As it turned out, the 2007 floods were the perfect dress rehearsal for the record-breaking rain that would fall on the UK in 2012. In particular, June 2012 walloped the June 2007 rainfall record, that itself had broken the previous record that had stood for nearly 40 years.

But, interestingly, summer 2012 was no repeat of summer 2007. While both experienced a similar jet stream position and record-breaking rainfall, differences include: precipitation patterns and timing; the weather and related soil conditions preceding the record-breaking rainfalls; flood defenses; and insured losses.

The Summer of Flood: 2007

In 2007, the UK experienced its wettest June since detailed record-keeping began in 1914. According to the UK Met Office, 136.2 mm of rain fell across the UK that month, nearly twice the normal amount. The flooding, which began on Monday, June 25, continued throughout the week and was exacerbated by heavy rain earlier in the month that set the stage with wet soil conditions and elevated water levels. The ground was saturated by mid-June, and many reservoirs that would normally have had capacity to absorb runoff were full. In addition, paved surfaces in urban areas behaved like saturated soil and contributed to surface water flooding. What was unusual in 2007 was for how many days the rain fell. Flooding started again on July 21 and again continued for a week.

The Jet Stream's Unusual Position

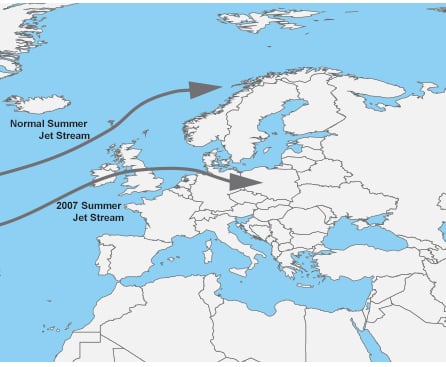

Some of the blame for the UK 2007 floods rests with the unusual position of the jet stream during that time. The jet stream, a conveyor belt of fast moving air 36,000 feet above the earth, controls the movements of extratropical cyclones. Normally, the jet stream lies across the Northern Atlantic during the summer months, allowing the UK some respite from the cloudy, wet weather that characterizes much of the year (see Figure 1).

But for much of the summer of 2007, the jet stream was positioned several hundred miles south of its usual position, bringing unusually heavy rain to the UK (see Figure 1). The Met Office stated that the amount of rainfall may have been exacerbated by warmer-than-normal sea surface temperatures (SSTs) around the UK during the preceding winter and spring. Higher SSTs result in increased evaporation, putting more moisture into the atmosphere which, in turn, can fall as rain.

Surface Water Flooding's Role in Damage and Loss

In its Review of 2007 summer floods, the Environment Agency stated that the 2007 floods were different in scale and type from other severe floods in the recent past. Specifically, a much higher proportion of flooding came from surface water rather than rivers. Two thirds of the 55,000 properties, or roughly 35,000 homes and businesses, flooded because drains and sewers were overwhelmed. Roughly 19,000 homes on floodplains were inundated by overflowing rivers. Of those, 3,600 were flooded when existing flood defenses were overwhelmed. The agency estimated, however, that a further 100,000 properties had been protected by artificially constructed defenses. Insured losses totaled about GBP 3 billion.

Although the Environment Agency issued 500 flood and severe flood warnings during the summer—80% of which the agency believes gave two hours' notice of flooding—the warnings only apply to flooding from major rivers; the agency's flood warning service does not issue warnings for surface flooding, or risk of flooding from sewers, drains, groundwater, or ditches. Many properties, according to the Environment Agency, were flooded twice—first by surface water, then by river water—so they received flood warnings only after they had already been inundated.

The Environment Agency stated in its 2007 review that "surface water flooding problems are likely to increase with development pressures, climate change, and aging infrastructure." In the metropolis of London alone, surface water was responsible for flooding virtually all the 1,400 properties affected.

Flood After Drought: 2012's Water Resource Turnabout

The two dry winters of 2011 and 2012 led to drought conditions across the UK, causing major roads to crack and reservoirs to hit their lowest recorded levels. On April 5, 2012, a "hosepipe ban" went into effect for 20 million people getting their water supply through the main water system, which meant that they were forbidden to use their garden hoses for most domestic purposes, such as washing a car, watering plants, or filling a backyard pool.

Then the rain began. The UK received a total of 126.5 mm of precipitation in April, more than double the rainfall for that month compared to the 1971-2000 average. It was the wettest April ever recorded. June 2012 also saw a record-breaking amount of rainfall over the UK—145.3 mm, exactly double the average. The wettest April to June period in the UK's history brought near total recovery from the drought by mid-July. Reservoirs became full or exceptionally high, and river levels tripled. Such a widespread and sustained recovery from drought had never been seen in the UK before, according to the Centre for Ecology & Hydrology.

The UK government had to turn on a dime from focusing on drought conditions in April to the risk of flooding in May, which persisted well into autumn. Between May and mid-October, the Environment Agency sent 100,000 direct warnings to households and businesses. UK insurers estimated by mid-July that their losses from June 2012 alone would reach GBP 500 million but posited that total costs would not exceed the costs of the 2007 floods. Through mid-October, 4,500 properties had been flooded in 2012 in the UK. The Environment Agency, Met Office, and Centre for Ecology & Hydrology have all warned that the UK must plan for swings between drought conditions and flooding periodically from now on.

"Futuristic" Flood Defenses Mitigate Losses

Although the position of the jet stream during the summer of 2012 was similar to that in 2007, there were a number of factors that prevented the 2012 floods from incurring the level of insured losses that 2007 did. One is that the record-breaking rainfall in 2012 followed a long period of drought, so the soil was not already saturated as it was in 2007. Also, there were periods of relief even during the record-breaking April-June period; the second half of May was relatively dry, and there were other periods of respite between the rain, which lessened the impact. The other, more important, differences were the increase in the number of flood defenses—190,000 more properties were protected in 2012—and the innovative types of flood defenses installed and implemented between the floods of 2007 and 2012.

Innovations in flood defense comprise a wide range of solutions, including upgrades to the warning system. The Flood Forecasting Centre, which is a joint Environment Agency and Met Office team, has significantly improved the lead time and accuracy of its flood forecasts, giving more notice and better information to emergency responders, infrastructure operators, and homeowners. In addition, the Environment Agency has added new online and social media applications, including Facebook Flood Alerts and Flood Alert apps for mobile devices, to their already existing flood warning communication channels of telephone, email and text messaging. In addition, map developers Shoothill have created live online flood mapping solutions that are directly linked to the Environment Agency's flood warning system to help users visualize what areas are under threat of flooding.

Other improvements in flood defense are a result of engineering innovations. Three examples follow. A flood defense that uses self-raising gates—a first for the UK—is being installed in Cockermouth, in Cumbria, which was flooded three years ago. The self-closing gates use the floodwater's power to raise the barriers and hold them in place. As the flood waters recede, the gates slowly descend. Another type of defense is the glass flood defense, used instead of a reinforced concrete defense to preserve the view. Keswick, also flooded in 2009, has just had a glass flood defense installed. And finally, in places like the village of Belford in Northumberland that experience frequent flooding when rain runs off nearby farmland, a combination of ponds to store floodwater and planted woodland to slow the flow of water have been installed—relatively cheap and effective ways to protect against flooding.

Paul Mustow, the Head of Flood Management at the Environment Agency, claims that 53,000 properties would have been flooded in 2012 without flood defenses—very close to the number that were actually flooded in 2007—and that 190,000 received flood protection during the intervening years. He also stated that flood defenses repaid their investment by a factor of 8-1 but that continuing to invest in them would be challenging, given government cuts to the budget.

The Future of Flood Insurance in the UK

Currently in the UK, flood insurance is made available to all under the "statement of principles" (see sidebar), which aims to provide affordable, near universal flood coverage. This system involves cross-subsidization of premiums from households in low-threat regions to households in high-threat regions. The statement of principles is due to expire in June 2013, leaving the future of flood insurance in the UK uncertain.

A number of brokers have already begun working on solutions in the form of UK flood pools. In addition, both the Association of British Insurers (ABI) and the British Insurance Brokers Association (BIBA)—lobbying arms of the insurance and insurance broking interests in the UK, respectively—are working with the government to develop a strategy for replacing the statement of principles, which would lead to a more objective risk-based system. If insurance companies were allowed to charge premium based on real risk to the property, in the long term it could arguably discourage construction in flood-prone areas; however, in the short term, a shift to this type of open system, without provision for people already living in flood-prone regions, would lead to hardship for some.

The ABI has estimated that if the statement of principles were to expire without contingencies in place, up to 200,000 households would struggle to obtain flood insurance at affordable rates. Thus, the likelihood of the creation of a government subsidized pool to help maintain affordable insurance in highly flood-prone regions seems to be quite high.

Flood is now the top natural hazard that the UK faces. The risk of flooding already threatens 5 million homes in the UK, and it is thought by UK government officials that climate change will increase that number. It remains to be seen whether innovations in flood defense and the insurance landscape in the UK will serve to increase the UK's resilience to flood hazard in the years to come.