Introducing the New AIR Severe Thunderstorm Model for Europe

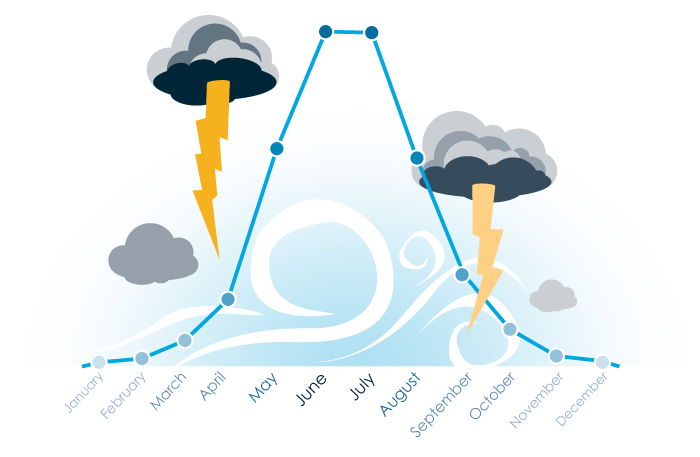

Severe thunderstorms can strike Europe at any time of the year, and their loss potential is increasing. There have been several events in the last 10 years that have resulted in insured losses exceeding EUR 1 billion, including a 2013 storm that struck multiple countries—Germany and France in particular—and caused more than EUR 3 billion in insured losses.

Protect your bottom line by accounting for the real-world behavior of severe thunderstorms.

A severe thunderstorm event can produce multiple outbreaks of hail and straight-line wind over the course of several days. The AIR Severe Thunderstorm Model for Europe uses adaptive clustering to group outbreaks that occur close together in space and time to reflect real-world conditions and better align with industry definitions of severe thunderstorm events.

Have confidence in your European severe thunderstorm model results.

AIR researchers incorporated claims data for many historical storms across multiple countries and companies in the development and validation of the model, as well as industry loss data from insurance associations in Germany, Austria, Switzerland, France, and many other sources, to ensure model results reflect actual loss experience.