A New View of Canada’s Earthquake Risk

Apr 18, 2014

Editor's Note: Better understanding of Canada's principal areas of seismic activity and the growing value of insured property within them have led to questions about the Canadian insurance industry's preparedness for a large earthquake. This article outlines why AIR undertook a major enhancement to the Canada earthquake model and how insurers can truly own their risk and comply with regulatory expectations.

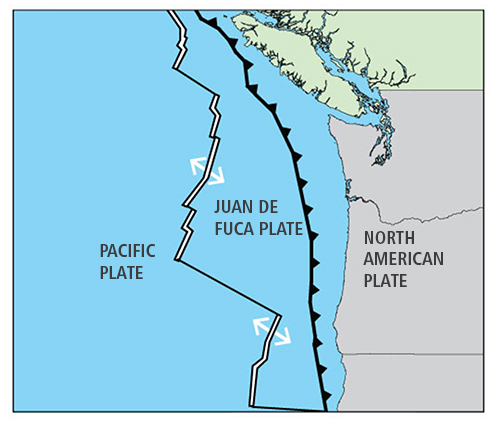

At about 9 p.m. on January 26, 1700, the largest earthquake known to have impacted Canada occurred off the west coast of North America. The massive "megathrust" earthquake with an estimated magnitude of 8.7-9.2 ruptured some 620 miles (1,000 kilometers) of the Cascadia Subduction Zone, from California to Vancouver Island.

The ground shook so violently and for so long on Vancouver Island that native peoples could not stand and some of their homes were destroyed. The quake caused ground along the coast of Vancouver Island to permanently drop around five feet, and triggered extensive landslides. It also unleashed a tsunami that struck Japan without warning a few hours later with waves 6 to 10 feet (2 to 3 meters) high.

A Better Understanding

Vivid memories of the 1700 Cascadia earthquake are preserved in the oral traditions of Vancouver Island's First Nations peoples, and the event left clear geological evidence, but it is not part of modern Canada's experience.1 It occurred before European settlers reached the area and is only documented in Japanese records of a mysterious tsunami. Only recently have these records been associated with the earthquake, enabling its date and magnitude to be estimated.

Not that long ago, few believed that the Cascadia subduction zone was capable of producing extreme earthquakes, but the last few decades of research have added enormously to our understanding of Canadian seismicity. We now know that M9.0 or greater quakes sporadically rupture the entire length of the subduction zone. Geological evidence indicates that the time interval between such quakes over the last 3,500 years has varied from 250 to 850 years, and they are considered to have a return period of 500 years or longer. Recent findings indicate more frequent ruptures of smaller magnitude earthquakes (~M8.0) in the southern part of the subduction zone.

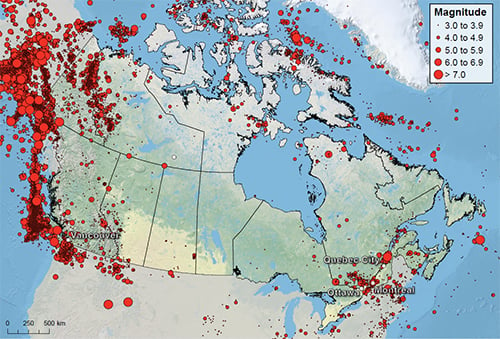

The region in which the 1700 Cascadia earthquake occurred is part of the Pacific Rim, around which about 81% of the world's largest earthquakes occur. Canada's segment of this so-called "Ring of Fire" generates the majority of the country's earthquakes, but there is a second seismic hot spot along the Ottawa and St. Lawrence valleys. Quakes are less frequent there than on the west coast, and less powerful. Still, large and damaging events have occurred in the past and are likely to do so again in the future. Natural Resources Canada suggests that there is a 5-15% chance that a strong earthquake will strike here in the next 50 years.2

Growing Exposure

Canada is no stranger to earthquakes—they happen all the time—but most are too slight to cause damage or occur in remote and sparsely populated areas. From a geological perspective, a very brief span of time has elapsed since European settlers arrived in the 1500s. Canada has since developed into one of the largest advanced economies in the world, and its growing exposure has contributed to escalating insured losses from a wide range of natural catastrophes. The damaging earthquakes that it has experienced in the past, although each was considered destructive and costly at the time, impacted a comparatively small population and a limited range of property—much of which was uninsured. Modern Canada has experienced nothing on the scale of the 1700 Cascadia earthquake and has yet to be impacted by the full range of possible seismic events.

Despite Canada's vast area, approximately 40% of its 35 million inhabitants live in the Lower Mainland of British Columbia and the Québec City—Windsor Corridor. The intersection of these two major concentrations of exposure with the country's most earthquake-prone regions accounts for 75% of Canada's seismic vulnerability.3

Massive offshore quakes like that of 1700 event happen very rarely, but less powerful inland temblors are more frequent. Because they can occur close to urban areas, they are considered by many to be more hazardous. A really significant earthquake has yet to strike one of the major concentrations of insured property to be found today in the highly-developed areas around Vancouver, Montreal, and Québec City. It is only a matter of time before one does.

An Extreme Makeover

In recent years, the increasing knowledge of Canada's seismic activity and improved understanding of the vulnerability of the country's building stock have outpaced the earthquake models available for this region. AIR's earthquake model for Canada was introduced in 1997, and underwent major revision in 2002 and minor updates in 2005 and 2008. Recognizing the need for a state-of-the-art model that meets the current needs of the industry in Canada, AIR has given its model a complete makeover. The updated version, to be launched this summer, has been extensively reengineered and offers significant updates and enhancements.

The hazard component features a comprehensively updated seismicity model for Canada using the latest historical earthquake catalog from the Geological Survey of Canada (GSC), which has been shared with AIR ahead of the official release of the GSC's national hazard map. AIR has also used paleoseismic and active fault data in western Canada, and constructed a comprehensive kinematic block model using GPS and other geodetic data to estimate the accumulation of seismic energy in the Cascadia Subduction Zone. This physically based model is especially useful for estimating the recurrence rates for rare, very large magnitude earthquakes.

In rebuilding the AIR Earthquake Model for Canada, the opportunity was also taken to ensure consistency between the U.S. and Canada earthquake models. Thus a unified stochastic catalog for both U.S. and Canada was created to enable insurers and reinsurers to quantify the risk to policies and portfolios that span the border.

State-of-the-art ground motion prediction equations have been incorporated. Detailed geotechnical and microzonation studies of several metropolitan areas, including Ottawa, Montreal, Victoria, and Vancouver are used to more accurately account for the impact of surficial soils on ground shaking. Major updates to the vulnerability module have been undertaken in collaboration with Canadian and international engineering experts and reflect a sophisticated understanding of regional building practices. Damage functions for industrial facilities and infrastructure have been added.

The devastating earthquakes that struck Japan (M9.0 in 2011), Chile (M8.8 in 2010), and New Zealand (M7.1 in 2010 and M6.3 in 2011) dramatically highlighted the major contribution to losses that can be associated with earthquake subperils. In addition to adding liquefaction and a greatly enhanced fire following model, the release is the first in the industry to include fully probabilistic landslide and tsunami models for Canada.

The industry exposure database has been completely overhauled and updated, and features a resolution of 1 km nationwide, updated risk counts, adjusted construction costs and construction types, occupancy types and policy terms.

AIR's model provides the most advanced and current view of shake, tsunami, landslide, liquefaction, and fire-following earthquake risk in Canada, and each component of the model has been extensively validated and peer reviewed by independent experts.

Conclusion

To raise awareness, stimulate debate, and to help insurance companies plan for and mitigate risk from future earthquakes, the Insurance Bureau of Canada (IBC) commissioned a comprehensive study in 2012 on the insurance and economic impact of major earthquakes in Canada. The IBC chose AIR to conduct the study using the updated model. Two realistic, large-loss earthquake scenarios, one off the coast of British Columbia and the other near Québec City, were modeled (view the infographic). Including indirect losses caused by the interruption of supply chains and the interconnectivity of economic sectors, the western scenario results in modeled economic losses of nearly CAD 75 billion (of which 20 billion is insured) and the eastern scenario causes economic losses of CAD 60 billion (of which 12 billion is insured).

These entirely plausible events have exceedance probabilities of approximately 0.2% (a 500-year return period). By the year 2022, regulatory guidelines in Canada will require insurers with exposures in both British Columbia and Québec to demonstrate cover up to the 500-year probable maximum loss—so this is a loss level for which companies should prepare.

With increased risk awareness and a principles-based regulatory framework that requires companies to demonstrate comprehensive understanding of their earthquake exposure, detailed modeling that makes use of the latest scientific and engineering knowledge is a critical component of managing Canada earthquake risk.

1 http://walrus.wr.usgs.gov/tsunami/NAlegends.html and Ludwin, Ruth S. et al., "Dating the 1700 Cascadia Earthquake: Great Coastal Earthquakes in Native Stories," Seismological Research Letters, March/April 2005.

2 http://earthquakescanada.nrcan.gc.ca/hazard-alea/simphaz-eng.php.

3Kovacs, P. Reducing the risk of earthquake damage in Canada: Lessons from Haiti and Chile. Institute for Catastrophic Loss Reduction, Toronto; 2010.

By: Dr. Bingming Shen-Tu

By: Dr. Bingming Shen-Tu By: Dr. Arash Nasseri

By: Dr. Arash Nasseri By: Jonathan Kinghorn

By: Jonathan Kinghorn