European Windstorms: Implications of Storm Clustering on Definitions of Occurrence Losses

Sep 20, 2010

Editor's Note: In this article, AIR Principal Scientist Dr. Gerhard Zuba and Managing Director of AIR Worldwide Ltd Dr. Milan Simic discuss AIR's novel approach to identifying and modeling winter storms and the implications of temporal storm clustering on loss occurrence definitions in reinsurance contracts.

Extratropical cyclones occur with considerable frequency in Europe during the winter months. On average, about 70 winter storms affect Europe each year, although only a few are powerful enough to pose a significant threat to property. However, from an insurance perspective, it is not merely the annual frequency or even the recurrence of catastrophic storms that must be considered. The temporal sequence of storms and the time that lapses between them can have significant implications for the structuring of reinsurance contracts. AIR's advanced techniques for modeling realistic temporal occurrence patterns of winter storms in Europe lead to improved reinsurance decision making.

What Causes Temporal Clustering?

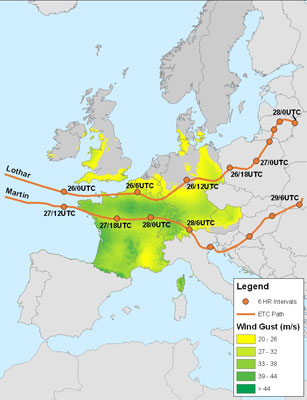

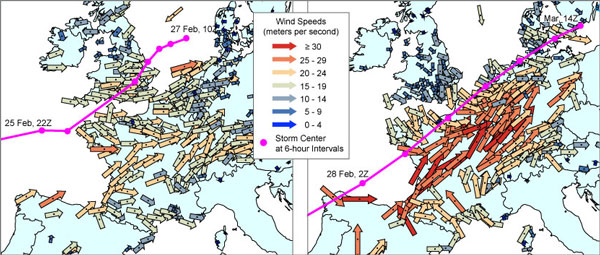

In recent memory, the most damaging winter storms in Europe rarely seem to strike alone. In the winter of 1989 to 1990, eight consecutive storms hit Europe in quick succession. The strongest, Daria—which was accompanied by some of the highest wind speeds ever recorded in Europe—roared across the UK and into northwestern continental Europe, claiming close to 100 lives and causing over 4 billion Euros of insured damage in six countries (based on 1990 currency). Less than a decade later, 1999's Lothar and Martin—with a combined insured loss of more than 6 billion Euros at the time—were separated by just 36 hours. More recently, 2007's Kyrill struck four days after Hanno, and Emma followed quickly in the wake of Johanna and Kirsten in 2008. Just last season, Xynthia swept through on the heels of Wera, costing the industry more than a billion Euros.

Reflecting on past storm seasons provides many more such examples, but the tendency for storms to follow each other closely in time, or to cluster, is not solely anecdotal. The first theory of storm clustering, proposed by Norwegian meteorologists in the 1920's, involved the development of cyclone "families", with a parent cyclone generating one or more similar cyclone spawns. In recent years, the availability of immense global sets of reconstructed historical atmospheric and climate data using numerical weather prediction (NWP), such as the reanalysis data developed by the National Center from Atmospheric Research (NCAR) and the National Centers for Environmental Prediction (NCEP), has allowed for more precise storm identification and more sophisticated analyses into the possible mechanisms behind storm clustering.

Mailier et al (2005) showed that storm clustering is statistically significant in northwestern Europe at the exit region of the typical North Atlantic storm track, but not at the entrance region near North America. His research suggests that storms form at regular intervals in the western North Atlantic, but that the variability in a number of large-scale climate patterns (including the North Atlantic Oscillation, the East Atlantic Pattern, and the Scandinavian Pattern) can influence their path and travel times over the Atlantic. These climate fluctuations ultimately lead to the clustered arrival of the storms in Europe. Further, consistent with anecdotal evidence, Vitolo et al. (2009) showed that storm clustering is positively correlated with the vorticity intensity of the cyclones, meaning that the stronger storms are more likely to cluster.

Defining Loss Occurrence Using Hours Clauses

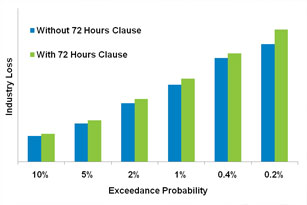

In the past decade or so, large loss catastrophes in Europe (including floods and clusters of winter storms) have prompted the industry to rethink traditional excess of loss reinsurance contracts that rely on an hours clause to define what constitutes an event. First introduced in the mid-20th century, hours clauses define a loss occurrence using a period of time. For windstorm risk, including tropical cyclones and winter storms, this time period is typically defined as 72 hours. Without the ability to scientifically determine when an event begins and ends, hours clauses limit the amount of loss that can be aggregated and attributed to a single occurrence. Conversely, but for very much the same reason, multiple events within that period of time may be treated as a single event. Thus, losses from multiple smaller storms (each of which, individually, may not be sufficient to trigger reinsurance recoveries) can be combined, and loss estimates published by the insurance industry for historical events often in fact result from a series of temporally clustered storms.

The traditional approach to the hours clause leads to some difficult questions. What if two clearly distinguishable storms occur within a 72-hour period (each of which causes large losses)? Must (will) they be treated as a single event (and thus subject to an occurrence limit), or are they eligible for two recoveries? What about two temporally clustered storms with non-overlapping wind footprints that affect an insurance company with a geographically diverse portfolio? Can even these be considered a single event? An additional complication is that the ceding company typically decides when to commence the 72 hour period, so long as it does not precede the occurrence of the first individual loss. However, individual claims are loosely date-stamped, not time-stamped, and it can be difficult for property owners and insurance companies to attribute a loss to a particular storm, assuming minor to moderate levels of damage.

These complexities demonstrate that traditional hours clauses leave a considerable gray area regarding what is eligible for reinsurance recovery. While these clauses in themselves do not favor one side over another, the differences in interpreting contract wording may necessitate third-party arbitration in the aftermath of an event.

Event-Based Definitions

With scientific and technological advances in the ability to identify and track individual storms and other meteorological phenomena, there is now a dedicated effort to more precisely define what a loss occurrence is. In particular, the industry has seen a shift from time-based definitions to more scientifically defensible event-based definitions. Gaining wide acceptance in the European reinsurance market is some variation of the wording contained in the LPO 98A clause, which defines loss occurrence to mean "all individual losses arising out of and directly occasioned by one catastrophe." However, the duration of the loss occurrence is limited to "72 consecutive hours as regards a hurricane, a typhoon, windstorm, hailstorm and/or tornado." (A similar loss occurrence clause used in North America is the NMA 2244/BRMA 27A.)

The term one catastrophe is generally understood to preclude the aggregation of losses that are attributed to two or more meteorological events that happen simultaneously or in quick succession within the 72-hour time limit. While LPO 98A does not put forth a definition for what constitutes a windstorm, weather agencies and meteorological institutes in Europe identify and track extratropical cyclones based on objective meteorological parameters. For example, The Institute of Meteorology at the Freie University of Berlin—a widely accepted meteorological authority in the European insurance industry—has named all high and low pressure systems that have affected weather in central Europe since 1954.

Indeed, some loss occurrence clauses go one step further in aligning event definition with the meteorological perspective, specifying that an event shall include insured losses that are directly occasioned by a single chain of causation, or an uninterrupted atmospheric disturbance. In such cases, the clause usually provides for the consultation of a neutral third-party with recognized expertise if there is some scientific uncertainty or dispute.

One remaining area of uncertainty is the issue of attributing losses to a particular event when two or more storms have overlapping damage footprints. Storm clusters can subject a single location to continuous damaging winds for several days; thus it is often left to the ceding company to decide which event is responsible for causing damage at each location.

AIR's Approach to Modeling Storm Clusters

As was previously noted, the propensity of winter storms to arrive in Europe in clusters is not simply anecdotal; it can be shown to be statistically significant and, as such, cannot be reproduced using a purely random process or Poisson distribution of annual frequency. Realistic modeling of Europe's winter storm risk depends on the ability to model explicitly this tendency of storms to cluster. In recent years, researchers have developed an improved methodology for identifying and tracking storms that allows for more accurate separation of temporally and spatially clustered events. In the 2010 update to the AIR Extratropical Cyclone Model for Europe, AIR scientists identified historical storms within the NWP reanalysis data sets by locating their vortex centers, which is less sensitive to the background state and allows for earlier storm detection than the traditional approach using mean sea level pressure. AIR employs a "block bootstrapping" methodology to explicitly capture the intraseasonal storm occurrence pattern and to preserve the tendency of storms to cluster.

AIR's novel approach results in a stochastic catalog with a higher, but more accurate, annual frequency of storms and a realistic temporal occurrence pattern that allows for improved analysis of reinsurance decisions. While event-based definitions currently prevalent in the industry still usually include an hours clause, its purpose is to limit the duration of any one loss-causing event, rather than to impose the need to aggregate losses from multiple storms occurring within that time period. Because extratropical cyclones in Europe are typically fast moving storms, the 72 hour limit (96 hours in some contracts) would cut off coverage in the middle of an event only in the case of a very widely distributed portfolio. Consequently, events in AIR's stochastic catalog are very consistent with meteorologically based loss occurrence definitions. A comparison of historical storms identified using AIR's new storm identification methodology shows very good agreement with named storms from the Freie University of Berlin.

The current state of practice in the industry, however, does not allow for the capability to address loss occurrence clauses explicitly within a catastrophe model. Contract language and specific terms—whether they are time-based or event-based—vary, and the unique geographic distribution of each portfolio has a paramount impact on what period of time an insurer will choose to define the loss occurrence in order to maximize recoveries, a decision that is not feasible to capture in software. Also, as mentioned previously, the difficulty in attributing losses to clustered storms with overlapping damage footprints could be a contentious issue. Furthermore, in the aftermath of an actual event, many factors besides the interpretation of contract wording—including good will, client relations, and even political considerations—can influence reinsurance payments. Companies who wish to analyze the implications of these remaining uncertainties regarding temporally clustered events can do so outside of the software using AIR's unique stochastic catalog in which individual events are time stamped with the day of the year on which the storm enters the model domain.

Conclusion

Historically, clusters of storms have often been treated as a single event, both from a meteorological and insurance perspective. Enabled by new science, the industry has seen a shift in recent years away from relying on a traditional hours clause to define a loss occurrence—a definition plagued with inconsistencies in interpretation and execution. Most importantly, the level of imprecision in these clauses makes it difficult (if not impossible) for all stakeholders—insurers and reinsurers alike—to understand the true scope of their risk.

Today, acceptance of the event-based loss occurrence definition, which is largely consistent with AIR's modeling approach, is a very positive direction, although some uncertainties in interpretation may still exist. By explicitly capturing temporally clustered storms and by accurately identifying individual storms within these clusters, AIR modeling technology provides a basis for future improvements in the structuring of more scientifically sound reinsurance contracts and other risk transfer alternatives, such as catastrophe bonds. This can ultimately give companies an objective and mutually understood means to price and transfer their winter storm risk.

International Underwriting Association, Hours Clause: Definition of Loss Occurrence, IUA Circular 116/09, November 2009

Mailier, PJ, Stephenson, DB, Ferro, CAT and Hodges, KI (2006): Serial clustering of extratropical cyclones, Monthly Weather Review, Volume 134, pp 2224-2240

Vitolo, R., Stephenson, D.B., Cook, I.M. and Mitchell-Wallace, K. (2009): Serial clustering of intense European storms, Meteorologische Zeitschrift, Volume 18, Number 4, August 2009, pp. 411-424(14)