No, this is not an overly scientific explanation of a long-lost “Seinfeld” joke; it’s a question we heard quite frequently when we were meeting with clients in New Zealand. For those of you who are unfamiliar with the regulations surrounding reinsurance buying in that part of the world, the Reserve Bank of New Zealand (RBNZ) establishes regulations for the industry with the intent to protect non-life insurers from insolvency.

Specifically, the Solvency Standard for Non-life Insurance Business 2014 includes a section on the Catastrophe Risk Capital Charge (CRCC) requirement. This section is generally referred to as the “1 in 1,000 year” requirement. In this blog we will unpack the CRCC to shed some light on what “1 in 1,000 years” really means and explain how the AIR Earthquake Model for New Zealand can be used to demonstrate compliance with this requirement.

At the heart of this provision is the quantification of potential future loss due to an “Extreme Event.” That may sound simple but determining what constitutes an “Extreme Event” can be somewhat complex. According to the requirement, the loss expected from an “Extreme Event” is the largest loss among three conditions:

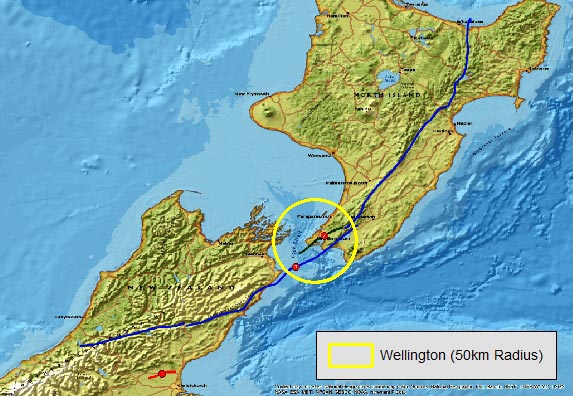

- Projected 1 in 1,000-year insured losses from the occurrence of a major earthquake impacting Wellington where Wellington is defined as all property covered by the insurer that is within a 50-km radius of the Executive Wing of the New Zealand Parliament Buildings (aka, “The Beehive”).

- Projected 1 in 1,000-year insured losses from the occurrence of a major earthquake affecting any place other than Wellington as defined above.

- Projected 1 in 250-year insured losses incurred from a non-earthquake event occurring anywhere within New Zealand or elsewhere.

It should be noted that the intent of the provision is to determine loss to the exposure inside and outside of Wellington irrespective of the event location. This means that an event causing a 1 in 1,000-year loss to the exposure inside the 50-km radius around the Beehive may occur outside this boundary. A plausible scenario is one in which a large subduction zone earthquake occurs along the Hikurangi Trench that runs along the east side of the North Island, causing considerable damage within Wellington.

We will demonstrate how to quantify the losses associated with conditions 1 and 2 using AIR’s proprietary industry exposure as an example to highlight some of the nuances of the RBNZ CRCC requirement.

First, the exposure was separated into two complementary subsets, one including all the risks within 50 km of the Beehive (i.e., Wellington) and another including all the risks beyond the 50-km radius (i.e., outside Wellington), where the 50-km radius around the Beehive is shown as the yellow ring in Figure 1. Approximately 12% of the replacement value for buildings, contents, and potential loss due to downtime falls within 50 km of the Beehive. Because this proportion of the total replacement value is small, one may assume that condition 2, which pertains to the remaining 88% of the replacement value falling outside Wellington, would result in the larger loss. But let’s see what happens when both portions of the industry exposure are analyzed using the stochastic event catalog available with the AIR Earthquake Model for New Zealand.

The exceedance probability (EP) curves were calculated for each exposure subset as well as for 100% of the building, contents, and downtime replacement value in New Zealand to determine the 1 in 1,000-year return period loss for each exposure. The losses for each exposure and corresponding CRCC condition are presented in Table 1 as a ratio of the 1 in 1,000-year loss for each exposure subset (i.e., condition) relative to the 1 in 1,000-year loss for the entire country.

| Exposure | Proportion of Country-Wide Exposure |

Ratio to Country-Wide Loss |

Mw | Location | Fault (Color in Map Above) |

Rupture Type |

|---|---|---|---|---|---|---|

| Wellington (Condition 1) | 12% | 73% | 7.4 | Wellington | Wellington Fault (Green) | Strike-slip |

| Outside of Wellington (Condition 2) | 88% | 50% | 7.0 | 32 km NW of Christchurch CBD | Springbank Fault (Red) | Reverse |

| All of New Zealand | 100% | 100% | 8.4 | North and South Islands | Multi-Fault Rupture (Blue) | Complex |

It is important to point out that the events that generate 1 in 1,000-year return period losses are different for each exposure. This is evidenced by the fact that the ratios to country-wide loss for the Wellington and Outside Wellington CRCC conditions sum to more than 100%. Furthermore, even though the replacement value within the 50-km Wellington radius makes up only 12% of the total replacement value of the country, the 1 in 1,000-year loss for the Wellington exposure is still 44% higher compared to the 1 in 1,000-year loss for the exposure outside Wellington. This observation highlights the high hazard in the Wellington area relative to other locations in New Zealand.

It should also be noted that these three events were identified to result in 1 in 1,000-year losses for the subsets of the New Zealand industry exposure that were the basis of this example. In practice, these events (and potentially even the governing CRCC condition) may change, depending on each individual insurer’s unique book of business. Therefore, it is important to make use of the available catastrophe modeling capabilities to quantify your own unique exposure to “Extreme Event” earthquake risk in New Zealand.