An hours clause stipulates that the cedent is only protected against the financial loss accumulated within a set number of hours of a catastrophe. Calculating the expected loss on a treaty with an hours clause is an ongoing challenge facing reinsurers.

AIR has previously studied the impact of the hours clause on UK flood losses , but here we investigate its impact on losses from hurricanes hitting the Caribbean and the U.S., so-called clash events. We show that although there is some overestimation of losses if hours clauses are not modeled, the expected discrepancy for clash events is less than 5% on the average annual loss (AAL) for typical hours clauses of 72 hours or more.

Hurricane Irma Example

Last September, Hurricane Irma wreaked havoc in the Caribbean and Florida. AIR’s damage survey graphically revealed the damage caused. Irma started deep in the Atlantic Ocean, storming through Anguilla, Puerto Rico, Cuba, and Florida. The event’s duration was around 12 days.

A reinsurer could have capped its loss by including an hours clause in its treaty. The cedent, in this case, would have recovered only the loss accumulated in a window of n hours where n is typically 72, 96, or 120. Figure 1 is a schematic loss profile that illustrates how losses from Irma could have evolved. The area under the profile represents the total event loss and the red-shaded area represents the maximum loss accumulated in a 72-hour window.

Although the cedent can select when the window applies to maximize their recovery, the reinsurer should pay less than the total loss if the hours clause is less than the duration for which the cedent experiences losses. “How much less?” is the question posed in this blog.

A method was devised to quantify the impact of the hours clause on a subset of events in the AIR Hurricane Model for the United States and the AIR Tropical Cyclone Model for the Caribbean, which I’ll call hereafter, for easy reference, the Atlantic Hurricane Model. The impact is measured by the savings made in the AAL. We also discover how sensitive the savings are to the duration of the hours clause.

Calculating Loss Profiles for Events Like Irma

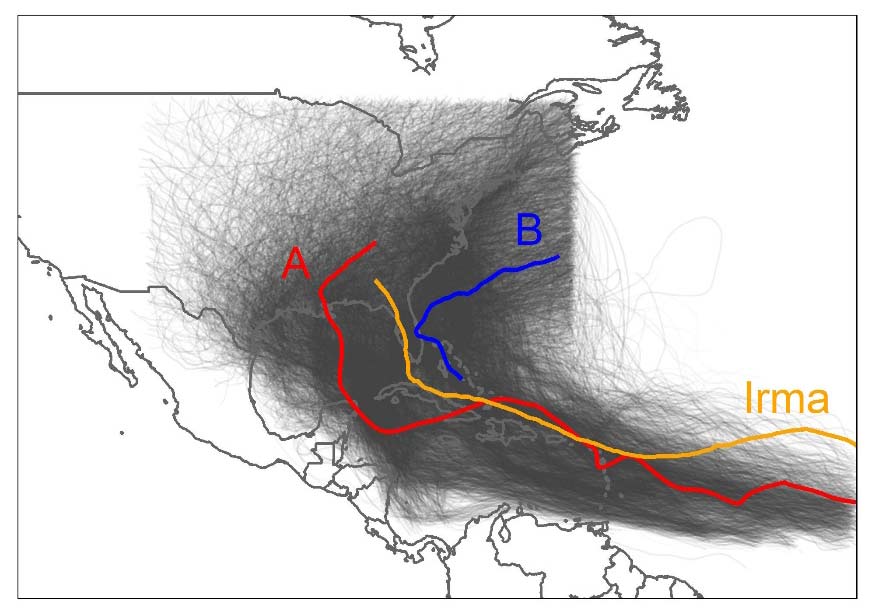

Irma was an event that caused losses to the Caribbean and the U.S. and made landfall on the U.S. There are around 10,000 such events in AIR’s 10,000-year standard catalog (the gray tracks in Figure 2). These events were selected for this study because they should be ideal candidates to illustrate the savings a reinsurer makes with the hours clause.

Highlighted in Figure 2 are the tracks of two stochastic events, A and B, and that of Irma. Notice that, like Irma, Event A has a long track that starts deep in the Atlantic and passes through many Caribbean countries and territories before reaching the U.S., whereas Event B has a shorter track that begins near the Bahamas.

Loss profiles can be derived by using the Atlantic Hurricane Model to get a relationship between loss and geographical area and by carrying out a spatial analysis on hourly track data to find a relationship between area and time. Mapping these two relationships together provides a relationship between loss and time and therefore a loss profile for each event.

Figure 3 shows loss profiles calculated for Events A, B, and Irma. Event A causes losses in 26 Caribbean territories in the model domain and three U.S. states over 18 days. Event B causes losses in the Bahamas and Florida over two days. While Irma causes losses in 21 Caribbean territories in the model domain and two U.S. states.

Figure 4 shows how the 72-hour accumulated loss varies with time for Events A, B and Irma. This was calculated using a “moving window” approach, similar to that adopted in AIR’s previous hours clause study. The cedent will maximize their recovery by taking the maximum 72-hour accumulated loss which we call the window loss. For Event A, the window loss is USD 22 billion, which is 35% of the total event loss, while for Event B, the window loss is USD 24 billion, equal to the total event loss. In this example, the hours clause has benefitted the reinsurer in Event A but made no difference to the reinsurer’s loss from Event B.

For Irma, the total event loss as modeled here is USD 49 billion and the window loss is USD 39 billion, saving the reinsurer with a 72-hour clause 21% on the payout.

The Impact of the Hours Clause Duration on the AAL

Analysis of Event A and Hurricane Irma suggests that modeled losses can be significantly overestimated if the hours clause is not modeled, but is this true for all events? The method was next used to quantify the impact of the hours clause on the industry insured AAL for the 10,000 or so events studied here.

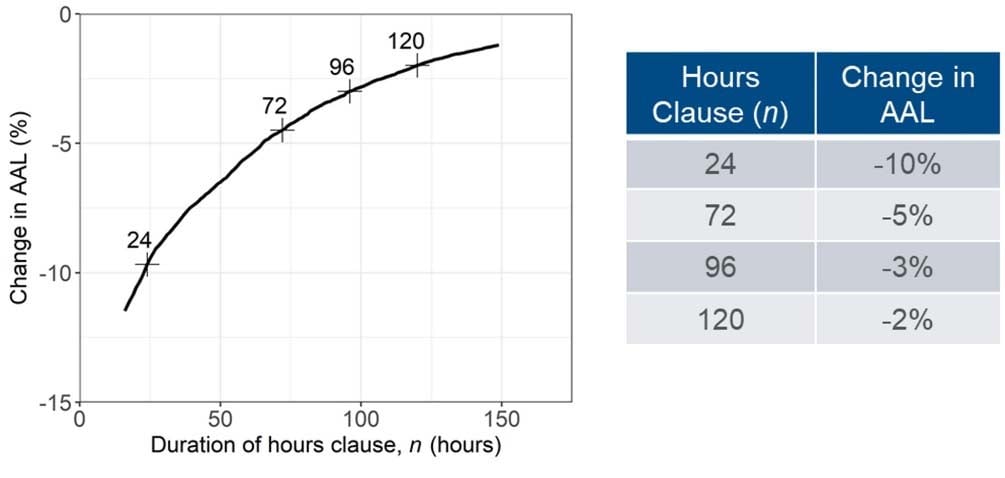

These clash events, which cause losses in the Caribbean and the U.S., should contain ideal candidates for illustrating reinsurer savings. In fact, we find that the traditional 72-hour clause leads to a savings of less than 5%. Figure 5 shows how the savings in modeled AAL varies with the hours clause duration for clash events. Savings of only 3% and 2% are made with the 96- and 120-hour clauses, respectively.

Note the AAL in this analysis was calculated on the full range of losses but in practice a treaty will only be triggered by high loss events. Also, when the analysis included events that caused a loss in the U.S. only, a smaller reduction in AAL was found.

The hours clause is designed to cap a reinsurer’s loss from an event. This post describes a method for estimating that loss for a selection of events in AIR’s Atlantic Hurricane model and quantifies the potential discrepancy between modeled losses with and without hours clauses being applied. On average, the discrepancy is small, being less than 5% for traditional hours clauses. However, for certain events such as Hurricane Irma, that have a long event duration and cause losses in many Caribbean islands and U.S. states, the difference can be significant. For Irma the estimated saving is 21%.