The 2018 United States Farm Bill is certain to have a significant impact on crop insurance and food and nutrition programs across the country. Not surprisingly, it was a popular topic of conversation at the AIR Crop Insurance Symposium that took place in Boston in May.

Looking Back at the 2014 Farm Bill

The Agricultural Act of 2014, commonly known as the 2014 Farm Bill, was enacted into law during a very different crop market than today’s. It was debated in the aftermath of the 2012 drought, responsible for one of the highest gross loss ratios since 1993. However, many producers were participating in government-subsidized crop insurance programs so that most farms received loss payments and ad-hoc disaster relief did not need to be issued by Congress.

Dr. Keith Coble, Giles Distinguished Professor and Agricultural Economics Department Head at Mississippi State University, noted at the Crop Symposium that the last Farm Bill was written at the end of one of the most profitable periods the U.S. agriculture industry had seen in decades. Dr. Coble served as the Chief Economist for the Minority Staff of the Senate Agriculture, Nutrition, and Forestry Committee during the 2014 Farm Bill debate, and he knows firsthand the negotiation challenges and budget constraints. Negotiations for the 2014 Farm Bill began in 2013. At the time, there was a great deal of focus on cutting back direct payments and increasing the crop insurance offering that had proven successful in 2012. As Dr. Coble explained in his presentation, Congress was looking to reduce overall crop subsidies by USD 23 billion as part of a budget reduction measure. This reduction served as motivation for eliminating direct subsidies. The result was a significant decrease in the cost of commodity programs administered by the USDA’s Farm Service Agency, and a slight increase in the funding of crop insurance.

The Agriculture Industry Today

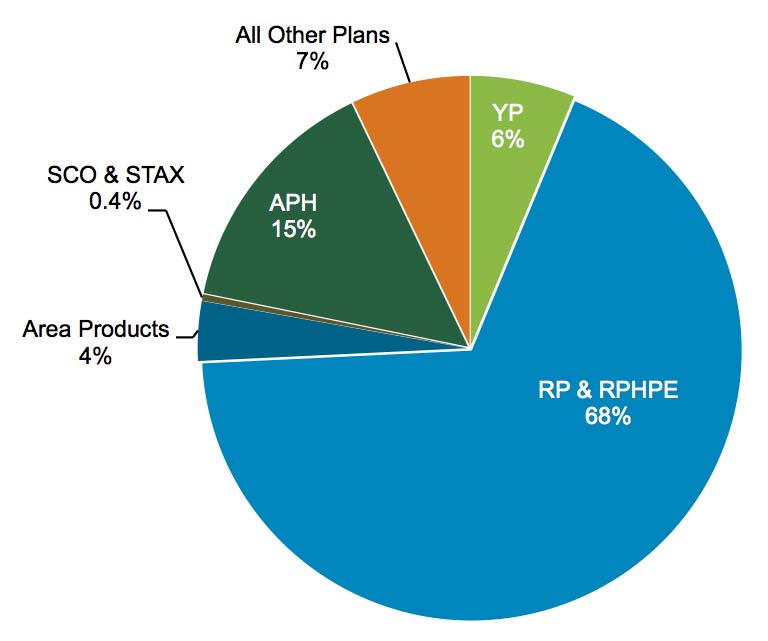

The conditions under which the next Farm Bill is being drafted are very different than those under which the 2014 bill was. As Dr. Julia Borman, Scientist at AIR Worldwide, discussed, 2015 and 2016 proved to be very good years for the crop industry, with record high yields for corn and soybean production in 2016 as well as the lowest gross loss ratio in the historical record since 1989. The number of acres enrolled in the program remains strong. Revenue protection with the Harvest Price Option, which protects producers against both price and yield risk, remained the most adopted insurance plan type with 68% of premium share in 2016.

Nevertheless overall farm income has been quite low, falling almost 30% since 2013, according to Dr. Robert Johansson, Chief Economist for the United States Department of Agriculture, who delivered a detailed review of the current state of the agriculture industry during his presentation at the Crop Symposium. Farm income health can also be measured by the new capital producers invest in. Dr. Johansson illustrated this point by saying that low equipment sales and a slight increase in delinquency rates show that farmers do not currently have the income to invest in improving their farms.

Dr. Bruce Sherrick, Distinguished Professor of Agricultural and Consumer Economics at the University of Illinois, explained additional contributing factors in his presentation. Although commodity prices have started to decline, the land values for most states have remained surprisingly strong. As a result, many farms are having difficulty showing a positive cash flow.

Negotiations are just beginning for the 2018 Farm Bill with various bills currently being reviewed by Congress. As the largest component of the farm safety net, crop insurance is now front and center in the discussions about budget reductions. Two major items currently under discussion are the reduction or removal of premium subsidies for large farms with adjusted gross income over USD 500,000 per year and eliminating subsidies for the Harvest Price Option. The former could be distortionary to the market as a whole; the latter would lead to a major change in producer policy choice.

There are many different proposals being considered for the next Farm Bill, all of which would be accounted for in AIR’s Multiple Peril Crop Insurance (MPCI) Model for the U.S. Clients who license AIR crop models should stay tuned for updates about the 2017 growing season by subscribing to our CropAlert® Growing Conditions Report.

To open a CropAlert subscription, contact AIR’s assistant vice president providing client support and services for the agricultural risk markets, Oscar Vergara.

Maximize profit potential and make better decisions with AIR crop models and services