A Multi-Peril View of Catastrophe Risk in China

Jul 24, 2013

Editor's Note: In this article, Heidi Wang, Senior Manager in AIR's Business Development group, and Albert Chen, manager of AIR's China operations, discuss the growth of China's insurance market and the increasing number—and value—of the country's exposures, which reinforce the need to take a multi-peril view of risk in China.

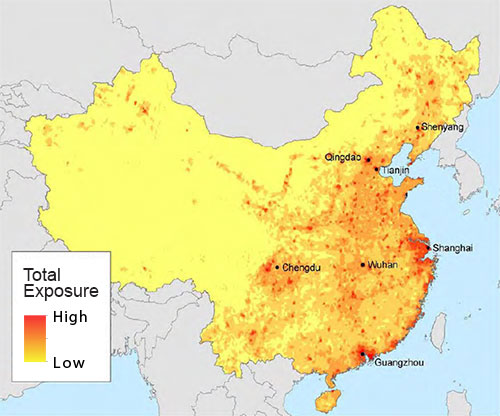

China's insurance market is relatively young, starting its modern era in earnest in the early 1980s. The non-life sector is overwhelmingly dominated by auto insurance, which has a 75% share of the overall market.1 But a population of 1.3 billion, whose urbanized middle class—expected to grow to 600 million by 20202—is increasingly interested in protecting its homes and businesses from flood, fire, windstorms, and earthquake. That translates into an opportunity for enormous growth in China's insurance market.

According to the National Bureau of Statistics of China, more than 8.5 billion square meters of floor space was under construction in the country in 2011, 11% of which was in just four municipalities—Beijing, Tianjin, Shanghai, and Chongqing. Beijing alone had more floor space under construction than 23 out of 27 entire provinces and territories.3

These exposures are at risk from a wide range of natural disasters that have caused about USD 11 billion in average annual economic loss from 1980 to 2010,4 more and more of which is expected to be insured as the industry grows. China's insurance market is starting to adopt more robust risk management practices, including those designed to meet the capital requirements of a new solvency schema projected to take effect by 2017.5

However, how to understand, manage, and price this risk remains a pressing challenge. Proactive risk management requires companies to have sophisticated tools to assess what potential future losses may be—before they occur. This is the question that catastrophe models were designed to address.

China's Second-Generation Solvency Regime Will Help Insurance Market Evolve

To keep pace with a burgeoning insurance industry, China's solvency regulations are evolving into what has been termed a "second-generation" risk-based and risk control system from a "first-generation" system that simply required 100% solvency ratios regardless of the risks companies undertook.

China's new solvency regime, overseen by the China Insurance Regulatory Commission (CIRC), is scheduled to go into effect no later than 2017. Under a risk-based regulatory system, companies' capital requirements will no longer be dictated by a one-size-fits-all regulation. Rather, insurers will have to demonstrate to regulators that their capital is sufficient to cover the risks they have undertaken.

The Importance of Modeling Catastrophe Risk in China

In light of the country's growth and its increasing regulatory stringency—both of which will serve to attract more global players—now more than ever it is important for insurers in China to have a deep understanding of their risk.

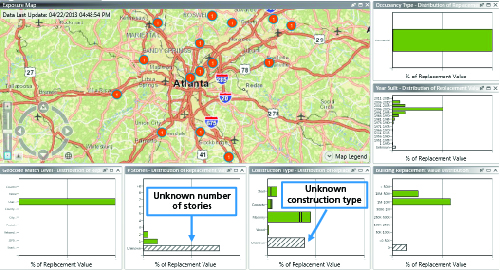

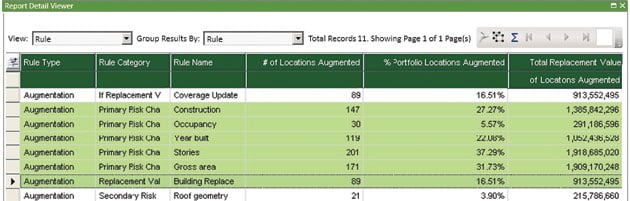

Because of China's historically low insurance penetration, claims data are scant, and indeed inadequate to determine probable losses from future catastrophe. Furthermore, the usefulness of the loss data that do exist is limited because of constantly changing property values, and repair and replacement costs. Building materials and designs change, and new structures may be more or less vulnerable to catastrophes than were the old ones. Finally, new properties continue to be built in areas of high hazard. Therefore, the limited loss information that is available is not suitable for directly estimating future losses.

By simulating risk probabilistically, insurers can use catastrophe models to answer fundamental and important questions, such as which perils, provinces, lines of business, and policy conditions drive loss. They can answer the question of how much loss a company can expect to experience from a single event, or over the course of a year. Because AIR's simulation approach models entire years of catastrophe activity and accounts for multiple loss-causing events occurring in a single year, it is ideally suited to answer such questions.

This year-based catalog approach also makes it straightforward to examine the total risk across multiple perils. Three such perils—typhoons, earthquakes, and agriculture risk—will be explored in more detail, followed by a discussion of why a multi-peril view yields the most realistic risk perspective and can reduce the capital requirements needed to grow new business.

Typhoon

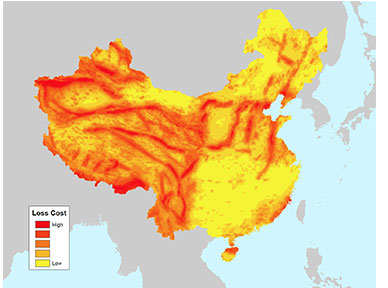

No other country experiences more tropical cyclones than China. An average of 11 such storms of varying strength affect the country annually. Significant economic losses from typhoons are incurred in both coastal and inland provinces. Wind losses are more frequent along the coast, while flooding is more frequent to the south as well as inland.

The destructive potential of cyclones was demonstrated most recently in 2012. Seven storms made landfall, and three—typhoons Saola, Damrey, and Haikui—struck during a single week in August. The costliest was Typhoon Damrey, which caused economic losses of CNY 20.86 billion (USD 3.28 billion) and insured losses of CNY 660 million (USD 124 million). It was followed by Saola 10 hours later. Five days later, Haikui struck and caused CNY 13 billion (USD 2.04 billion) in economic losses and CNY 1.46 billion (USD 230 million) in insured losses.6

An important characteristic of typhoons in the Asia-Pacific region is that even those with relatively low wind speeds can be accompanied by catastrophic flooding, which can extend hundreds of kilometers inland and persist for several days after landfall. The AIR Typhoon Model for China captures the risk from both wind and flood—an important feature given that both perils are covered under standard residential, commercial and construction all risks/erection all risks (CAR/EAR) policies.

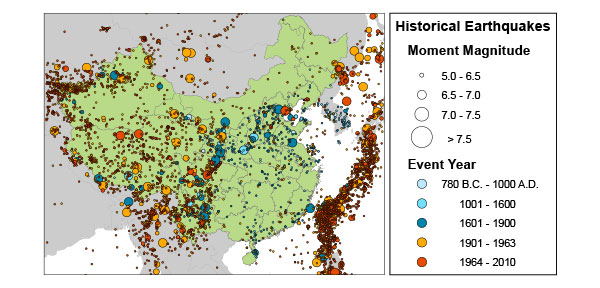

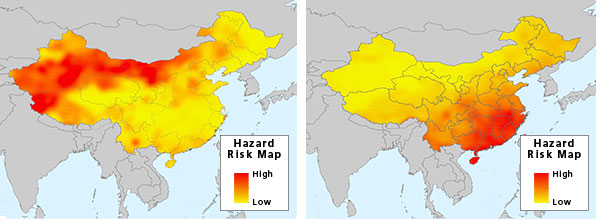

Earthquake

In April 2013, an M6.9 earthquake struck a largely rural region of Sichuan province about 70 miles west-southwest of Chengdu. The quake caused more than 150 fatalities and significant property damage. Still, it was a small event compared with the M7.9 Wenchuan earthquake, which struck in this same seismically active region five years before and was one of China's costliest natural disasters, with economic losses estimated at well over USD 100 billion. That event killed nearly 70,000 people, leveled nearly 7 million buildings, and damaged another 24 million.

If Chengdu had been affected, or a large city like Beijing, which is also in an area of relatively high seismicity, earthquakes at these magnitudes could cause much more significant losses than were seen in either of these events. At present, such an event would be underinsured, but this is changing.

Both the AIR typhoon and earthquake models for China capture the variability in both the vulnerability and replacement cost of buildings under construction, which is important given the fast pace of new construction in China. The models also enable companies to estimate losses for policies that contain the complex terms and conditions common in China.

Agriculture Risk

Crop insurance is the fastest growing sector in China's insurance industry, with premiums totaling CNY 24 billion in 2012. A primary distinction between crop insurance and other lines is the correlation of losses across wide regions—the result of large-scale adverse weather events like droughts and floods. AIR's Multiple Peril Crop Insurance (MPCI) Model for China captures the impact of these events, as well as damage to crops resulting from typhoons, which can bring torrential rainfall hundreds of kilometers inland. In China, weather is to blame for 90% of all crop losses. AIR estimates that a repeat of the 2007 summer-long drought could cost crop insurers billions of yuan today.

The MPCI model for China employs AIR's Agricultural Weather Index to accurately capture the severity, frequency, and location of potential adverse weather events, while also correctly preserving the timing of events during the season. Complex policy conditions, which vary by crop type, peril, and province, are fully supported by the model.

The Relative Risk

In light of the upcoming solvency regime, for which CIRC has already issued new guidelines requiring domestic insurers to submit comprehensive assessment reports—including solvency margins and a company development plan—it is critical for companies to have an objective and scientific approach to managing their catastrophe risk.

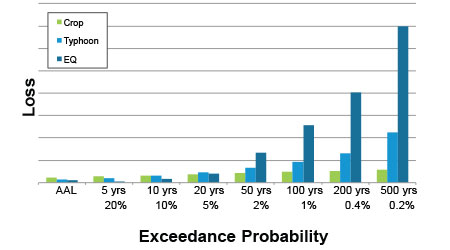

A common measure of risk is the loss at a given return period or, inversely, exceedance probability. At lower return periods (higher exceedance probabilities), typhoon and crop losses are significant, as illustrated by the 20% and 10% exceedance probability loss (five- and 10-year return period loss) in Figure 6. At higher return periods (lower exceedance probabilities), earthquake loss potential is several times higher than it is for the other two perils, as illustrated by the 100-, 200-, and 500-year return periods in Figure 6.

Given a geographically diversified portfolio, analyzing risk across multiple perils will provide a more realistic view of loss potential that will benefit insurers looking to reduce capital requirements in order to grow business. Furthermore, because events are date-stamped in AIR's catalogs, a multi-peril view will also preserve the seasonal correlations in losses.

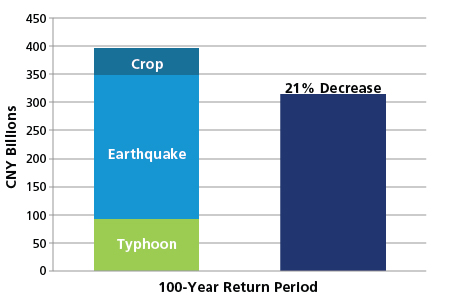

When considering all three perils, the combined modeled loss at higher return periods is typically significantly less than the sum of the individual peril losses at that return period. At the 100-year return period, for example, the losses can be about 20% lower for the three perils combined for a nationally distributed portfolio (see Figure 7).

This is just one of the benefits of having catastrophe models for several perils in a single country—the ability to accurately estimate combined losses.

AIR is also developing a China flood hazard map to address the risk from riverine flooding, which affects two-thirds of the country. Scheduled for release in 2014, the map will be available for use in AIR's Touchstone platform, giving companies an even more comprehensive view of their risk in China.

1 http://www.asiainsurancereview.com/News/View-NewsLetter-Article?id=27142&Type=eDaily

2 http://www.uscc.gov/sites/default/files/3.7.13_Simchak_Testimony.pdf

3 http://www.stats.gov.cn/tjsj/ndsj/2012/html/O1535E.HTM

4 http://www.preventionweb.net/english/countries/statistics/?cid=36

By: Heidi Wang

By: Heidi Wang By: Albert Chen

By: Albert Chen