Hedging Catastrophe Risk Using Industry Loss Warranties

Aug 23, 2012

Editor's Note: In this article, Michael Wedel, Manager in AIR's Consulting and Client Services Group, discusses how industry loss warranties are used to hedge catastrophe risk—as well as how AIR's CATRADER® software can be used to evaluate hedge effectiveness.

Reinsurers, hedge funds, and insurance-linked securities (ILS) investors (collectively "funds," and separately, "the fund") look for ways to construct a diversified portfolio of risk that provides strong and consistent profits. Funds achieve this goal by ceding the risk they do not want to cover while keeping or adding new risk they do want to cover.

Occasionally, during construction of a strong and diversified portfolio, a fund may uncover financial instruments (including industry loss warranties, or ILWs) that have similar risk attributes but substantially different pricing. Such mismatch results in an arbitrage opportunity, whereby a fund can take advantage of price discrepancies between two contracts that cover a similar risk profile.

This article provides an illustrative example.

Portfolio Construction

Assume a fund writes a USD 5 million excess of loss ("XOL") reinsurance contract based on indemnity losses to a primary insurance company (or "cedant") writing residential exposure in Florida. This indemnity contract could have been purchased through the traditional reinsurance market or through an alternative risk transfer vehicle, such as a catastrophe bond. In this example, the price to the cedant, or rate on line, associated with the contract is 18.00%. In other words, the fund receives an 18.00% premium on the USD 5 million of coverage they provide.

If, due to a hurricane, losses to the cedant are in excess of the indemnity contract's retention, the fund will be responsible for paying the cedant USD 5 million. The fund is able to assess the likelihood that this will happen by performing a detailed modeling of the cedant's portfolio against 10,000 years of simulated hurricane activity within AIR's CLASIC/2™ software. The fund can then apply reinsurance contract terms in CATRADER®.

In this example, the fund determines that the annual probability that losses in excess of the indemnity contract's retention will occur is 2.75%.

The settlement timeline of indemnity losses is time-consuming and relatively nontransparent—time consuming because it may take years for claims to be reported and nontransparent because losses are reported by the cedant. Therefore, the fund may look for opportunities to hedge their catastrophic risk exposure. One such method to hedge is through purchase of an industry loss warranty (see sidebar, Industry Loss Warranties).

Industry Loss Warranties

Industry loss warranties ("ILWs") are a type of reinsurance contract in which one party purchases financial protection from another in the event that insured industry losses from a catastrophic event are greater than a predefined trigger amount. For example, one party may purchase a Florida hurricane ILW that pays out USD 5 million if insured industry losses arising from a single Florida hurricane exceed USD 50 billion. Industry loss determination is fast and reasonably transparent, and thus easy to understand and trade. A variety of ILWs exist; some are based on all perils occurring in the U.S., others are based specifically on California earthquakes or Florida hurricanes, and others, on non-U.S. perils, including European windstorms.

For the purposes of this example, assume the fund has two ILW contracts available to it: a USD 30 billion Florida hurricane ILW and a USD 50 billion Florida hurricane ILW. The USD 30 billion ILW has a rate on line of 17.50% (as of May 2012)1 and the USD 50 billion ILW has a rate on line of only 11.00% (as of May 2012), commensurate with its lower risk profile. If a fund purchases USD 5 million of coverage based on the USD 30 billion ILW, the cost of the hedge is USD 875,000 (or 17.50% of USD 5 million). By contrast, if a fund purchases 5 million of coverage based on the 50 billion Florida hurricane ILW, the cost of the hedge is USD 550,000 (11.00% of USD 5 million).

Similar to the detailed modeling of the cedant's portfolio, using the same 10,000 years of simulated hurricane activity, the fund can assess the likelihood that losses from hurricane activity would be in excess of either ILW's trigger amount; this time by analyzing losses to total industry exposure in Florida.

Table 1 compares the likelihood that losses in excess of each of the three contracts' trigger amounts, respectively, occur. The 2.75% figure in row one means that hurricane losses in excess of the indemnity contract's trigger amount occur to the cedant's portfolio 275 times out of the 10,000 simulated years. Insured industry losses in Florida in excess of USD 50 billion occur with a similar probability, 2.54%, suggesting this ILW might have a similar risk profile to the original indemnity contract.

| Contract | Applies to Area | Trigger-type (binary) | Premium | Probability of Losses in Excess of Trigger |

|---|---|---|---|---|

| Indemnity XOL contract | Florida | Indemnity | 18.00% | 2.75% |

| USD 30 billion Florida Hurricane ILW | Florida | Industry Loss | 17.50% | 4.56% |

| USD 50 billion Florida Hurricane ILW | Florida | Industry Loss | 11.00% | 2.54% |

An additional analysis is required to determine whether the same simulated events impacting the indemnity contract are impacting this ILW, but before evaluating results from that analysis, consider the following terms that define the basis risk scenarios that could result given participation in an indemnity contract and purchase of an ILW.

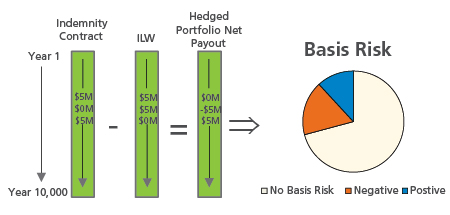

- Negative Basis Risk2: In this scenario, the fund has to compensate the cedant and does not receive the ILW payout.

- No Basis Risk: A scenario that causes a payment under both the indemnity contract and the ILW.

- Positive Basis Risk: In this scenario, the fund does not have to compensate the cedant and does receive the ILW payout.

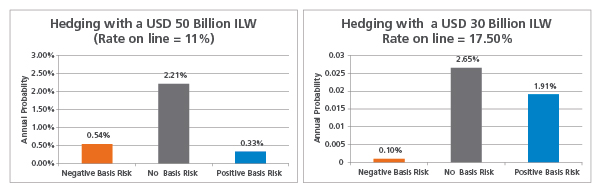

Figure 1 illustrates these basis risk scenarios for the fund in our example, and in consideration of both the purchase of the USD 50 billion ILW, which—as previously discussed—is triggered with an annual probability similar to that of the indemnity contract, and of the USD 30 billion ILW.

Focusing first on the figure's left hand panel, which is specific to the USD 50 billion ILW, we see, from left to right:

- There is an annual probability of 0.54% that indemnity losses occur in excess of the indemnity contract's retention but insured industry losses are below the ILW's trigger, USD 50 billion.

- There is an annual probability of 2.21% that indemnity losses occur in excess of the indemnity contract's retention and insured industry losses are in excess of the ILW's trigger, USD 50 billion.

- There is an annual probability of 0.33% that insured industry losses occur in excess of the ILW's trigger, USD 50 billion, but indemnity losses are below the indemnity contract's retention.

If, by comparison, the fund buys the USD 30 billion ILW (instead of the USD 50 billion ILW), there is a lower annual probability of negative basis risk (0.10% as opposed to 0.54%) and a higher annual probability of positive basis risk (1.91% versus 0.33%).

By participating in the indemnity contract, the fund receives a premium: 18.00% on the USD 5 million of coverage it provides. If the fund buys the USD 30 billion hedge, it will almost entirely eliminate the risk of loss to its portfolio (0.10% annual probability of a USD 5 million loss), obtain a USD 5 million payout from the ILW with an annual probability of 1.91%, and receive USD 25,000 (the difference between the rate it is receiving for the indemnity contract, 18% of USD 5 million, and the rate it is paying for the USD 30 billion ILW, 17.50% of USD 5 million). Alternatively, the fund could buy a USD 50 billion hedge for the given price (11.00%). In this case, as the modeled loss results in Figure 1 revealed, the fund has a higher negative basis risk, a lower positive basis risk, and receives USD 350,000 (the difference between the rate it is receiving for the indemnity contract, 18% of USD 5 million, and the rate it is paying for the ILW, 11.00% of USD 5 million).

Even upon quantifying the risk associated with two different financial instruments, selecting which instrument to purchase is no trivial task. In this example, the USD 50 billion ILW, while less expensive, is associated with a higher negative basis risk—although, notably, chances of negative and positive basis risk are quite similar, which may make this ILW appealing to some. The USD 30 billion ILW, meanwhile, though more expensive, hedges nearly all of the fund's negative basis risk, a very attractive prospect to others.

Portfolio Management in CATRADER

To fully benefit from industry loss warranties, potential buyers need credible ways to quantify and manage basis risk. AIR's CATRADER software, which helps users differentiate between risks that exist when considering two different financial instruments, is well suited to perform the analysis of the hedge outlined above. In order to model the hedged portfolio, a user sets up two programs—the first for the indemnity contract and the second based on industry hurricane losses in Florida. Under the 'Options' tab, within the Florida ILW program, the user must select "Contract Gain," which causes losses under the contract to be portrayed as gains. For example, if a USD 30 billion event occurs, triggering the ILW, CATRADER will show this as a negative USD 5 billion payout. The ILW payout is combined with positive losses from the indemnity contract to determine the net payout from the event for the hedged portfolio. Positive net payouts are losses to the hedged portfolio (negative basis risk) and negative net payouts are gains (years of positive basis risk).

Conclusion

The increased popularity of alternative risk transfer vehicles provides catastrophe risk managers with more tools to manage risk well. Using CATRADER, risk managers can identify effective hedges and quantify the risk associated with their portfolio. Through this process, they may even uncover arbitrage opportunities.

1 Price guidance reflects market conditions as of May 2012. As of August 2012, price guidance has decreased—15.00% for a USD 30 billion ILW and 9.00% for a USD 50 billion ILW—resulting in a more attractive hedging opportunity.

2 Note that the definitions of basis risk provided above are applicable to this analysis and may differ in other situations. For example, 'No Basis Risk' sometimes includes all simulated years of equal payment—including simulated years in which zero modeled loss occurs.