During the third week of June this year, AIR's London Insurance-Linked Securities (ILS) Team attended the annual Convergence London seminar and Trading Risk Awards Dinner, which reviews and celebrates the past year's activity in the reinsurance and convergence markets.

The first event, the Convergence London seminar, was hosted this year by Trading Risk in collaboration with The Insurance Insider in honor of the year's topic, "Blurred Boundaries," a reference to how traditional and alternative reinsurance markets are becoming less distinct. The seminar included four talks from industry leaders, covering current key issues in the market.

A key theme of the discussions was the call for diversification within the catastrophe bond space, both geographically and structurally. Over the past decade, there has been significant growth in the number of issuances, with much of the covered risk being in the United States and concerning the main perils in the region, hurricanes and earthquakes. Furthermore, the majority of U.S.-based deals cover Florida hurricanes on an indemnity basis.

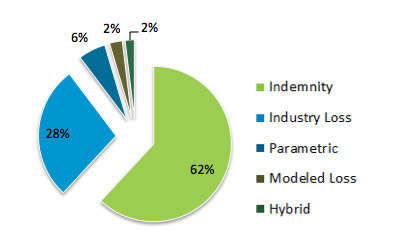

Cat bonds outstanding as of March 2015 have various trigger mechanisms, but indemnity deals have dominated (Source: AIR)

Discussions at the Convergence seminar exhibited an eagerness for expansion into other territories and perils so that investors can develop well-diversified portfolios, with a mixture of regions, perils, sponsors, and trigger types.

Over the past several years, the market has developed an appetite for non-U.S. perils, including European wind, Italian earthquake, and transactions covering Japan and Australia. It is evident that there is a sense of excitement about this expansion,and AIR has been fortunate to be involved in several of these innovative deals.

Looking into what the future holds for the industry revealed there were some key themes in addition to diversification.

First, there is potential for changes to occur in the market following a large event. However, pension funds have recently begun investing in cat bonds and ILS, which make up a small part of their funds, and investors like these are unlikely to retreat at the first sign of loss.

Second, in light of disasters such as the Nepal Earthquake there could be a greater amount of government-sponsored parametric deals in regions with low insurance penetration.

Third, there are thought to be two hurdles within the market-tail risk and reinstatements-and there was an appeal for a creative solution other than leveraging rated reinsurance.

The appetite for diversification was demonstrated on the following evening at the Annual Trading Risks awards, when Generali's Lion Re transaction-a European wind transaction triggered on an indemnity basis, and issued by a European domestic insurer-was awarded the "Non-Life Transaction of the Year" award. In addition, Credit Suisse's Kelvin Re, an example of the creative convergence of the capital markets and the reinsurance world, took home the "Initiative of the Year" and further highlighted the continued blurring of the boundaries between alternative capital and traditional reinsurance.

And I cannot fail to mention my own satisfaction when AIR was named "Market Facilitator of the Year" for our continued work in the ILS space, representing both sponsors and investors.